Uber (NYSE:UBER) will release its Q1 financial results on Wednesday, May 8. The momentum in its top line will likely be sustained in Q1, driven by higher gross booking volumes. Moreover, disciplined investment in new growth opportunities and a focus on improving margins will likely support its bottom line.

Uber provides ride-hailing, food delivery, courier, and freight transport services.

The company is witnessing an increase in gross booking volumes led by higher trips in the Mobility segment. It’s worth noting that Uber is benefitting from the growing number of drivers on its platform, the increase in monthly active consumers, and higher engagement. Moreover, it is adding more restaurants to its platform to strengthen its delivery business.

Uber – Q1 Expectations

Wall Street expects Uber to post revenue of $10.1 billion in Q1, up about 14.5% from $8.82 billion in the prior-year quarter. An increase in drivers and higher monthly active consumers will likely drive trips and gross booking volumes on its platform and, in turn, its overall revenues.

It’s worth noting that Uber reported a 24% increase in trips to 2.6 billion during Q4 of 2023, which drove its gross bookings.

Improved sales, a focus on improving margins, and a disciplined capital investment strategy will likely cushion Uber’s bottom line. Analysts expect Uber to report earnings of $0.22 per share, compared to a loss of $0.08 in the year-ago quarter.

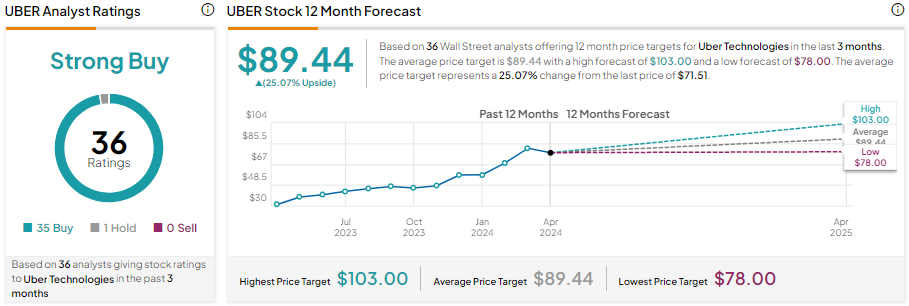

Is Uber a Buy or Sell Right Now?

Uber stock has rallied over 84% in one year. Despite this notable growth, Wall Street is bullish about its prospects ahead of Q1 earnings.

Uber stock has a Strong Buy consensus rating, reflecting 35 Buys and one Hold recommendation. Analysts’ average price target on UBER stock is $89.44, implying 25.07% upside potential from current levels.

Insights from Options Trading Activity

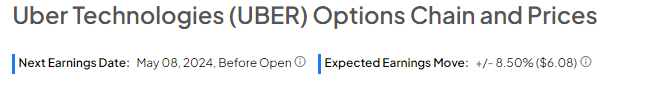

While analysts see decent upside potential in UBER stock, options traders are pricing in a +/- 8.50% move on earnings, greater than the previous quarter’s earnings-related move of 0.26%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Uber is likely to benefit from an increase in trips in the Mobility segment led by higher engagement on its platform. Moreover, the company’s focus on improving margins will likely support EPS growth. Adding to the positives, analysts are bullish about UBER stock ahead of Q1.