Take-Two Interactive (NASDAQ:TTWO) has been one of the biggest names in video gaming around, especially since it’s the studio behind the “Grand Theft Auto” series, along with developer Rockstar Games. But Take-Two Interactive voluntarily got a little smaller recently, planning a huge new set of layoffs and a pair of studio closures. The move helped Take-Two, but not by much; shares were only up fractionally in Thursday afternoon’s trading.

Take-Two revealed plans to shutter Roll7 and Intercept Games, which was responsible for “Kerbal Space Program 2,” the sequel to the cult classic physics game that saw you attempt to get little yellow guys into orbit. The responsibility for the game’s post-launch support will go to Private Division, its publisher. Take-Two staged the layoffs as part of a larger plan to “identify efficiencies across its business,” which would help cut costs in the midst of a difficult environment for gaming right now.

“Survive to ’25”

Going around the internet, in gaming development circles, anyway, is a punchy little motto that some say sums up the industry right now: “Survive to ’25”. Essentially, it means to circle the wagons, take few risks, preserve cash, and get to 2025, when things are more likely to look better than they do right now. Mobile gaming, for example, now believes its “golden age” has passed, and the “squeeze” phase has officially kicked in.

It’s far from alone there, and Take-Two’s move here might well be seen as an expression of the “Survive to ’25” ethos. The Game Developers Conference (GDC) event was said to be full of “Survive to ’25” sentiment, and given the upcoming slate of games for the rest of this year, that may not be too far off.

Is Take-Two Interactive Stock a Buy or Sell?

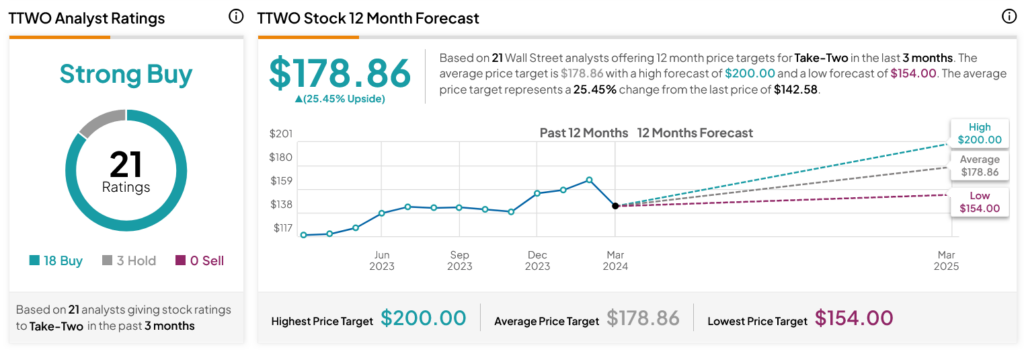

Turning to Wall Street, analysts have a Strong Buy consensus rating on TTWO stock based on 18 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 16.8% rally in its share price over the past year, the average TTWO price target of $178.86 per share implies 25.45% upside potential.