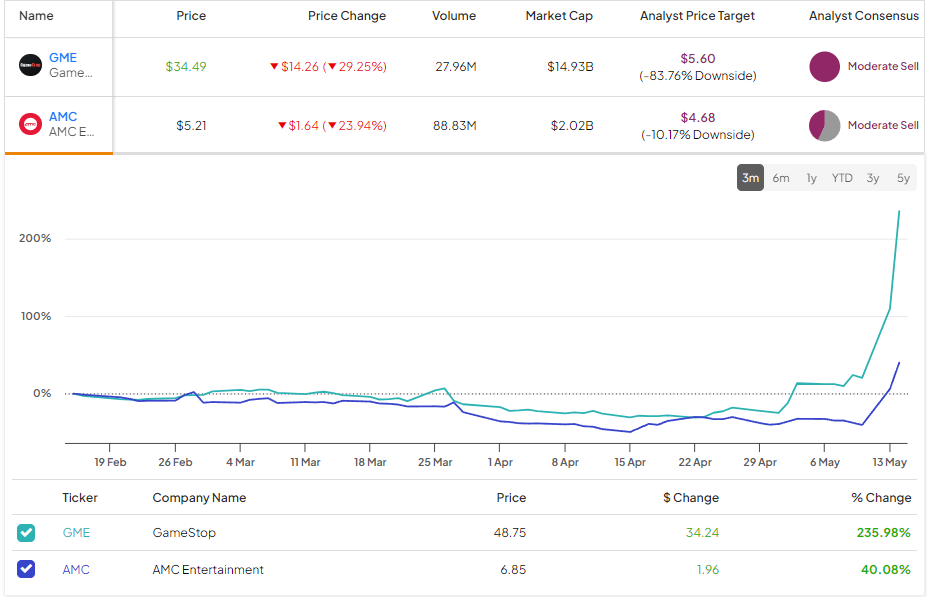

The recent surge in shares of GameStop (NYSE:GME) and AMC Entertainment (NYSE:AMC) has captured the attention of both Wall Street and Main Street. Over the last couple of weeks, GameStop’s stock price has skyrocketed by 265%, with AMC trailing with an impressive 103% increase in its share price.

The putative reason is Roaring Kitty is back on social media.

Roaring Kitty, the pseudonym of Keith Gill from Massachusetts, first gained fame in 2021 by promoting GameStop. With over a million followers on X, his recent post of a cryptic image depicting someone playing a video game has reignited interest and spurred activity in both GameStop and AMC stocks.

For Wall Street pros, however, these actions are seen as irrational. Among the critics is Steve Sosnick, Chief Strategist at Interactive Brokers, who comments, “I can understand chasing momentum, but this has gotten insane.”

Sosnick offers straightforward advice for investors. “Should investors buy now? NO!” he exclaims. “GameStop wasn’t a fundamental value at $9 or $10, it wasn’t at $30, and it certainly isn’t at $60.”

According to Sosnick, the stocks are rising as investors attempt to capitalize on the momentum, hoping to sell their positions before prices inevitably fall back down to reality. He sees this behavior as a classic example of the ‘greater fool theory’ in action.

“The greater fool theory is just basically saying, I know this is dumb, but somebody will do something dumber,” explains Sosnick. “That’s a really bad way to invest.”

GameStop “is trading so beyond any fundamentals and is so divorced from any historic measures,” says Sosnick. “It’s basically pure momentum, pure enthusiasm, pure social media frenzy.”

To this end, Sosnick advised those holding onto GameStop and AMC to take profits while they can. “If the stock is up 500% on no fundamental news other than that a key person posted a meme, it’s probably a good time to take a profit,” he says.

Proving his point, that’s exactly what AMC did.

“AMC – for better or worse – I think has been effective at embracing their meme stock status,” notes the strategist. “One of the ways they were able to pay down the debts was by selling stock when it got hot. They did so [again], the stock is up another 100%… The company is telling you that it was a good sell.”

However, shorting either company is an inherently risky proposition, as there is no rhyme or reason for how much longer the prices will continue to rise. “You don’t want to get in the way of the freight train,” says Sosnick.

Sosnick advises would-be investors to sit this one out. “If you’re getting into these stocks, you’ve got to realize that what you’re buying is just not worth the price you’re paying,” he says.

All in all, Wall Street has a pessimistic outlook on GME and AMC right now. Not only do the stocks show a Moderate Sell consensus, but the current consensus price targets indicate a double-digit downside risk.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured strategist. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.