Apparel stocks have been met with some serious volatility in recent quarters, with some of the high flyers suffering considerable falls from grace—think PVH—while some underdogs—like SKX and CROX—have seemingly swooped in to take share. Of course, only time will tell what could be next for these turbulent consumer discretionaries as macro headwinds, high rates, and inflation hit hard and consumers change their spending patterns.

Either way, recent shifts in the apparel scene have been remarkable, and in this piece, we’ll use TipRanks’ Comparison Tool to have a closer look at three apparel Strong Buys in the analyst community to see which comes out on top.

Crox (NASDAQ:CROX)

Crocs is a popular clog maker that exploded during pandemic lockdowns, soaring around 1,500% from its 2020 depths to its eventual November 2021 peak. Since peaking, Crox stock shed a big chunk of its lockdown-era gains, as it became less acceptable to spend most of one’s day in a pair of arguably ugly but incredibly comfortable shoes.

However, more recently, shares have begun to pick up traction, clocking in 75% of gains in the past two years. All of a sudden, those pandemic-era all-time highs aren’t so far out of sight. With robust newfound momentum and the faith of most Wall Street analysts, I remain bullish on the stock.

With post-pandemic demand normalizing and growth back on the table, now seems like a great time to get back into the stock. Looking ahead, the firm seems poised to take a page out of the playbook of some of its footwear rivals by embracing collaborations.

Notable collaborations with Nascar and anime Jujitsu Kisen could tap into very different fanbases that may not have otherwise considered spending a few dollars on comfortable footwear. Such limited edition “drops” also tend to appeal to sneakerheads (footwear collectors). Indeed, such brand collaborations have resulted in numerous win-win propositions for a wide range of firms regardless of industry.

So, whether we’re talking about the latest anime Crocs or a celeb-endorsed fast-food meal, it’s clear collaborations are getting the attention of younger generations. With 30 HEYDUDE (Crocs’ sister brand) outlets to be opened this year, analysts have the right to be upbeat as consumers shift from expensive sneakerhead brands toward cheaper, comfier alternatives.

What Is the Price Target for CROX Stock?

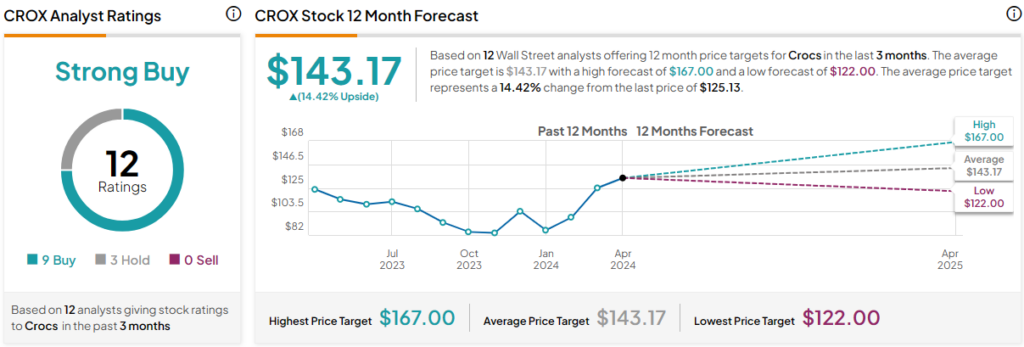

CROX stock is a Strong Buy, according to analysts, with nine Buys and three Holds assigned in the past three months. The average CROX stock price target of $143.17 implies 14.4% upside potential.

PVH (NYSE:PVH)

PVH is a diversified apparel firm behind popular upscale brands such as Calvin Klein, Tommy Hilfiger, and Van Heusen. With PVH, you’ll gain exposure to casual attire, activewear, underwear, and accessories, just to name a few product categories. The stock has been a horrid roller-coaster ride through the past decade, surging and plunging on numerous occasions, ultimately ending lower by 15% over the timespan.

Indeed, it’s frustrating to be a PVH shareholder, but I think there are plenty of reasons to stay the course. With intriguing catalysts and a depressed valuation to get behind, the next 10 years could have the potential to be a heck of a lot brighter than the last. All things considered, I remain bullish.

More recently, PVH stock shed around 22% on the back of some rough quarterly results. Wedbush Securities stepped forward, calling the plunge a buying opportunity, given its “margin expansion opportunity” for its top brands and the potential for retail trends to shift favorably. I’m inclined to agree. Wall Street may be overreacting to some quarterly results that I didn’t think were all too bad.

Of course, it was the muted 2024 outlook that had investors hitting that sell button. In light of the apparel industry volatility, I’d argue the softer guidance was only prudent. Either way, I’m a fan of the stock while it’s going for 10.1 times trailing price-to-earnings.

What Is the Price Target of PVH Stock?

PVH stock is a Strong Buy, according to analysts, with 12 Buys and three Holds assigned in the past three months. The average PVH stock price target of $134.50 implies 21% upside potential.

Skechers (NYSE:SKX)

Skechers is a relatively small footwear firm that I did not expect would be trading close to all-time highs in the face of tremendous volatility in retail and apparel. I certainly didn’t think it would have put footwear giant Nike (NYSE:NKE) to shame, with more than 100% in gains over the past five years versus Nike’s mere 7% gain. Undoubtedly, Sketchers isn’t just benefiting from a more value-conscious, inflation-rattled consumer. It has also done a lot to offer next-level comfort in its sneakers.

Collaborations, marketing, and slick designs have also helped its cause. With another quarterly beat in the books, I’m not inclined to give up SKX stock quite yet. Neither is Wall Street. As such, I’m staying bullish on the $10.3 billion high flyer as it looks to leave its footwear rivals behind.

Skechers delivered a solid first quarter (earnings per share of $1.37 vs. $1.10 estimate), but it was the hiked full-year guidance that really had investors piling into the stock. For 2024, sales are now expected to be in the $8.73-8.88 billion range, up from $8.6-8.8 billion. It’s a slight forecast raise but a notable one nonetheless for a company that’s found a way to make strides over its much larger peers.

Perhaps Raymond James’ Rick Patel put it best, Skechers is showing “broad-based strength in a lousy macro.” As a discretionary with almost defensive characteristics and what appears to be some pretty durable growth, it’s no mystery why analysts like Patel are fans of the stock right now.

Patel has a Buy rating on SKX stock with a $72.00 price target, recently hiked from $66.00.

What Is the Price Target of SKX Stock?

SKX stock is a Strong Buy, according to analysts, with eight Buys and two Holds assigned in the past three months. The average SKX stock price target of $68.50 implies 4.2% upside potential.

Conclusion

The apparel scene has been hit with quite a bit of pressure, but not all players have succumbed to the industry woes. With promising trajectories and fairly modest multiples, the following apparel plays seem like interesting bets. As investors take profits on pricier growth stocks in favor of more value-rich offerings, analysts view PVH stock as having the most to gain, with an estimated upside of about 24%.