Investing is all about profits and returns – no one puts their money into a stock without an expectation that the investment will make money. The trick is finding the stocks that deliver the best returns.

There’s a tendency to want to jump on the bandwagon, to buy into the big names that have grabbed the headlines. And that can bring in profits – there is no doubt that Microsoft and Nvidia have shown astounding growth over the past year. But there is also profit and potential to be found under the radar, in smaller stocks with lower prices. The risk is higher, but the possible upside can be astounding.

For less than $5 per share, investors can find penny stocks with triple-digit upside potential. These stocks offer a combination of factors: low entry cost, high return potential, and endorsement from Wall Street analysts. This makes them worthy of investors’ attention.

With this in mind, we’ve used the TipRanks database to pull up the details on two such opportunities. Both have received enough support from Wall Street analysts to earn a ‘Strong Buy’ consensus rating. Not to mention each boasts substantial upside potential of over 300%.

Eledon Pharmaceuticals (ELDN)

We’ll start with Eledon, a clinical stage biopharmaceutical company specializing in immune-modulating therapies for life-threatening conditions. Eledon is currently focusing its efforts on the development of tegoprubart, a new drug with significant implications in the field of organ transplantation. Specifically, tegoprubart has the potential to reduce organ rejection, increase transplant function, and enhance patient longevity post-transplant. That’s a tall order for one drug, but if achieved, it can prove to be a gold mine for Eledon.

So far, early testing has shown that tegoprubart has potential. The drug operates through several mechanisms of action, primarily by targeting the CD40 ligand, or CD40l. Blocking this pathway impacts the communication of key immune cells and increases a specialized population of T cells that suppress immune response. These actions, aimed at preventing immune response against foreign tissues, give tegoprubart its potential as a protective agent for transplanted organs.

On the clinical side, Eledon currently has tegoprubart undergoing two parallel studies: the Phase 2 BESTOW trial, which aims to enroll as many as 120 kidney transplant patients, and concurrently, a single-arm Phase 1b clinical trial aimed at preventing rejection in patients receiving kidney transplants. The company recently reported enrollment of the 12th patient in the BESTOW trial, and also recently amended its protocol for the Phase 1b trial to allow a second cohort and eventual enrollment of up to 24 patients in the study.

Looking forward, these trials should bring important milestones to Eledon this year. The company should report interim clinical data from the Phase 1b trial during 2Q24, while the BESTOW study should complete enrollment by the end of this year.

Against this backdrop, several members of the Street believe ELDN’s $1.60 share price looks like a steal.

Among the bulls is Leerink analyst Thomas Smith, a 5-star analyst rated in the top 1% of the Street’s stock pros. Smith recognizes tegoprubart’s promising potential, noting, “We remain encouraged by tegoprubart’s clinical profile to date and continue to see its best-in-class potential in kidney transplant based on potential advantages on both efficacy and safety/tolerability vs. current standard-of-care. We expect that ELDN’s two parallel studies in kidney transplantation will continue to build on these encouraging results, and we continue to view ELDN as an attractive pureplay option in the burgeoning CD40L/CD40 space… We remain optimistic on tegoprubart’s efficacy/safety profile ahead of additional data in kidney transplant expected in 2Q24.”

To this end, Smith rates ELDN shares an Outperform (i.e. Buy), and his $7 price target points toward a one-year upside potential of 332%. (To view Smith’s track record, click here)

The Leerink view may prove to be the conservative perspective on ELDN. The stock’s Strong Buy consensus rating is supported by unanimous positive reviews from five analysts, with an average price target of $15.60 suggesting ~863% upside from the current share price. (See ELDN stock forecast)

Acumen Pharmaceuticals (ABOS)

Next up is Acumen, a biotech firm focusing on developing new treatments for Alzheimer’s disease. Alzheimer’s is a devastating illness that affects the memory of patients, ultimately leading to a loss of their ability to function independently. There is hope on the horizon, however, and Acumen is part of it.

New drugs have slowed down the progression of Alzheimer’s, and Acumen is one of many companies working on treatments with even greater potential in the treatment of the disease. Acumen is currently working on treatments with a ‘disease-modifying’ approach, designed to target the underlying causes of the condition. This is a field ripe with potential, as there are currently some 6 million Alzheimer’s patients in the US, 32 million globally.

Acumen has developed a drug candidate, sabirnetug (ACU193), and brought it into the clinical trial stage. The drug is a selective targeting agent working against toxic soluble amyloid beta oligomers, or AβOs. These are known to be an early trigger of Alzheimer’s and have been shown to be ‘persistent drivers’ of the neurodegeneration and other pathologies of the disease. Acumen’s sabirnetug helps to preserve neurologic function by preventing toxic AβOs from binding to dendritic spines.

Early clinical trials showed promise, and the company is now on track to initiate a Phase 2 clinical study during 1H24. The Phase 2 trial, ALTITUDE-AD, will study the efficacy of sabirnetug against early Alzheimer’s disease. A Phase 1 study, looking at a subcutaneous dosing option for sabirnetug, is also expected to start this year.

This biopharma company has caught the eye of analyst Geoff Meacham from Bank of America. Meacham sees Acumen’s drug candidate as a strong asset, but he also perceives the background conditions as favorable for the company.

“We continue to think ACU193 offers intriguing upside as a next—and possibly best-in-class—mAb by specifically targeting Aβ oligomers vs. its competitors. Indeed, while admittedly early, we thought the phase 1 data looked differentiated given its rapid onset of action on key biomarkers and limited safety issues. At the same time, Acumen should benefit from 1) a favorable regulatory backdrop; 2) infrastructure investments from its commercial rivals; and 3) improving clinical experiences (new guidelines, expanding diagnoses, enhanced treatment protocols/ risk mitigation, etc.). Thus, while we recognize the clinical and commercial risks, we continue to see strong upside potential,” Meacham opined.

Building on these thoughts, Meacham proceeds to rate ABOS shares as a Buy, assigning the stock a $14 price target, which implies an upside of ~329% within a one-year horizon. (To watch Meacham’s track record, click here)

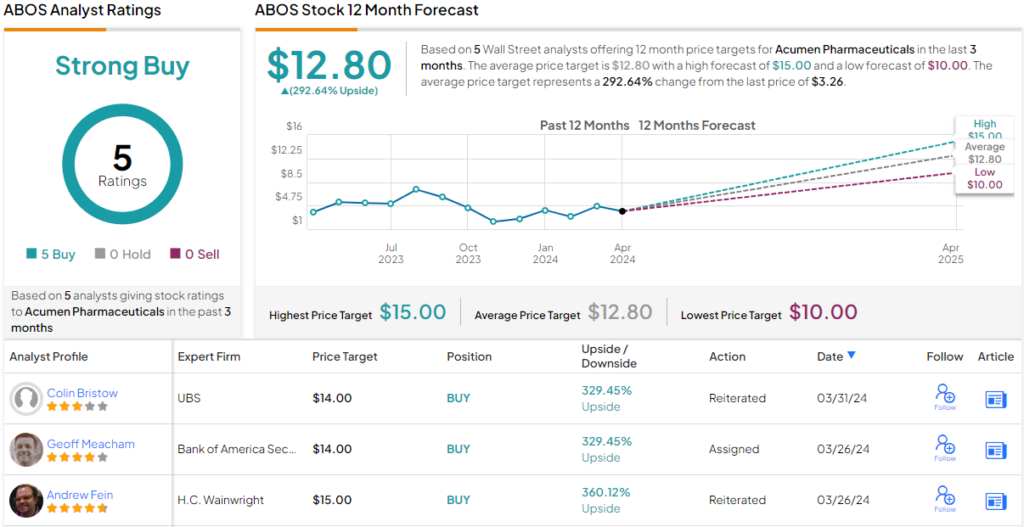

Overall, Acumen gets its Strong Buy consensus rating from 5 unanimously positive analyst reviews. The shares are trading for $3.27, and their $12.80 average price target suggests ~293% share appreciation for the coming 12 months. (See ABOS stock forecast)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.