AI has been the stock market’s main theme over the past year and a half, with the tech giants vying for a piece of this lucrative market. Yet, the game-changing tech has so far been curiously absent at one of the biggest market leaders.

Apple (NASDAQ:AAPL) has yet to seriously step up its AI game although that is expected to change somewhat with the upcoming iPhone 16, which is expected to have some AI tricks up its sleeve.

Trying to get more info on Apple’s AI plans, Evercore’s Amit Daryanani, a 5-star analyst rated in the top 4% of the Street’s stock pros, recently hosted a call with an Apple/GenAI expert to gain some insights on its overall AI strategy.

As per the expert, Apple finds the widespread popularity of chatbots intriguing, yet the company thinks the “real magic” of AI lies in its capacity to enhance everyday functionality by being integrated into the software. Of course, Apple realizes the significant interest from consumers and investors in chatbots like Chat-GPT/Gemini, hence their ongoing exploration of potential partnerships with OpenAI or Google to incorporate such cloud-based features. “These partnerships will likely eventually include some kind of revenue sharing similar to the Apple/Google deal,” said Daryanani on the matter.

Apple has a “key advantage” in that its own silicon reduces the need for extensive capex, as the NPU (neural processing unit) on most Apple devices already handles “some pretty heavy duty AI functionality.” The expert anticipates that future advancements in Apple silicon will prioritize the NPU.

The prospect of AI becomes even more intriguing when considering hardware products that will be built from the ground up with AI integrated at every stage. According to the expert, Apple is already developing two such products. The first being a tabletop device resembling a robotic arm, poised to harness Large Language Models (LLMs) so to “enable significant functionality.” The second product in the pipeline is anticipated to be a household robot.

“Net/net,” Daryanani summed up, “We continue to think Apple’s more measured approach to AI fits best with is existing product portfolio and strategy. Robotics are an underappreciated application of Apple’s AI work that blends hardware and software.”

For those wanting to get a more comprehensive look at what Apple has mapped out in AI, Daryanani expects plenty of features will be announced at WWDC in June.

Bottom-line, Daryanani rates AAPL as an Outperform (i.e., Buy), along with a $220 price target, suggesting the stock will post growth of 21% over the next year. (To watch Daryanani’s track record, click here)

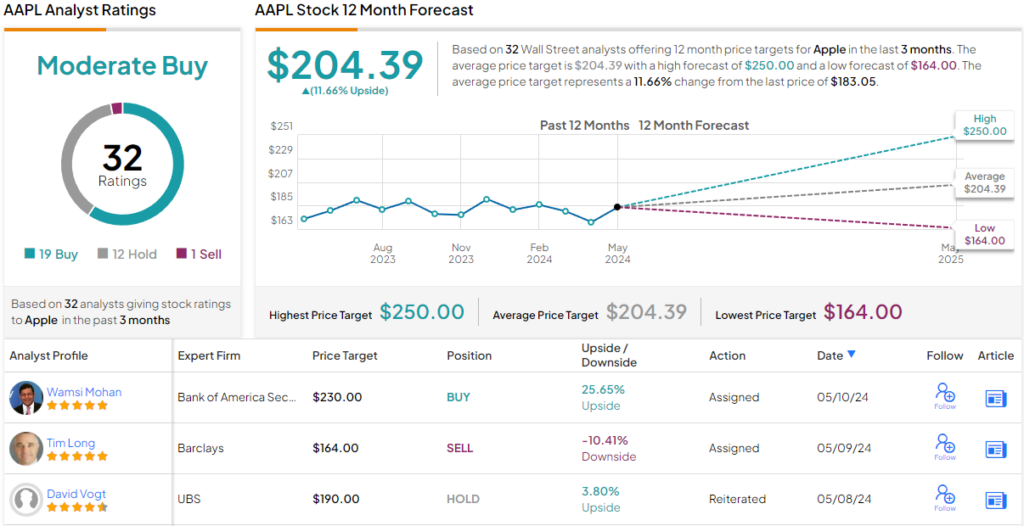

Amongst Daryanani’s colleagues, current support for Apple is decent but not conclusive. Based on 19 Buys, vs. 12 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. The forecast calls for one-year returns of ~12%, considering the average price target stands at $204.39. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.