Financial technology company SoFi (NASDAQ:SOFI) will release its Q1 2024 financial results on Monday, April 29. Though concerns regarding loan expansion could restrict its top-line growth, the strength of its Tech platform and Financial Services segments, growing lending capacity, and cost-saving measures will likely support its financials in Q1.

Before we delve into analysts’ Q1 estimates, it’s worth noting that SoFi stock is down about 23.7% year-to-date. Macro headwinds and investors’ concerns over potential equity dilution weighed on its share price. Nonetheless, the company has performed well over the past year, driven by high-quality loans and deposits, improved credit metrics, and a lower cost of capital.

SoFi – Q1 Expectations

Analysts expect SoFi to post revenue of $553.81 million in Q1, up over 17% year-over-year. Despite analysts’ forecast being within management’s guidance range of $550 million to $560 million, it reflects a moderation in its revenue growth rate sequentially.

Meanwhile, Wall Street expects SoFi to turn positive on the EPS front in Q1, compared to a loss of $0.05 per share in the prior-year quarter. SoFi’s ongoing growth in high-quality deposits is expected to result in reduced funding costs and savings, which will likely cushion SoFi’s bottom line in the first quarter.

Is SoFi Technologies a Buy, Sell, or Hold?

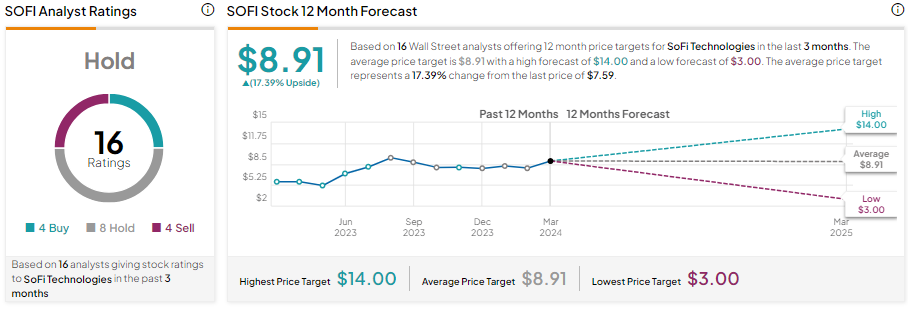

SoFi Technologies stock is a Hold ahead of the Q1 earnings print. Among the analysts covering SOFI stock, four recommend Buy, eight maintain a Hold, and four suggest Sell.

Analysts’ average price target on SOFI stock is 8.91, implying 17.39% upside potential from current levels.

Insights from Options Trading Activity

It’s worth noting that options traders are pricing in a +/- 14.62% move in SoFi stock on earnings, smaller than the previous quarter’s earnings-related move of 20.21%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

The Bottom Line on SOFI

SoFi’s Q1 earnings will likely benefit from the ongoing momentum in the Tech platform and Financial Services segments. Moreover, higher personal and student loan originations and cost savings will likely support its financials. Nevertheless, the macro headwinds could continue to pose challenges and impact its loan growth rate.