SoFi Technologies (NASDAQ:SOFI) has reported better-than-expected earnings for Q1. The fintech company experienced a notable turnaround, achieving a profit in Q1 with earnings of $0.02 per diluted share, compared to a loss of $0.05 per share in the same period last year. This performance surpassed the consensus earnings estimate of $0.01 per share.

In addition, the company’s Q1 adjusted net revenues surged by 26% year-over-year to $580.6 million, beating Street estimates of $553.8 million. Moreover, SoFi’s combined revenue from financial services and tech platform segments grew by 54%, comprising a record 42% of the company’s total adjusted net revenue.

In the first quarter, new member additions totaled approximately 622,000, contributing to a total membership exceeding 8.1 million by the quarter’s end, marking a 44% year-over-year increase.

SOFI’s Forward Guidance

Looking ahead, SoFi anticipates that its tech platform and financial services segments will be key drivers of growth. The company is aiming to increase their combined share from 38% of total adjusted net revenue in 2023 to approximately 50% in FY24.

Furthermore, management expects that adjusted net revenue for FY24 will fall within the range of $2.39 to $2.43 billion, surpassing its previous guidance of $2.365 billion to $2.405 billion. Earnings per share for FY24 are projected to range between $0.08 and $0.09, exceeding the prior guidance of $0.07 to $0.08 per share.

In the second quarter, management expects to deliver adjusted net revenues in the range of $555 million to $565 million with adjusted EBITDA likely to be between $115 million and $125 million.

What Is a Fair Price for SOFI Stock?

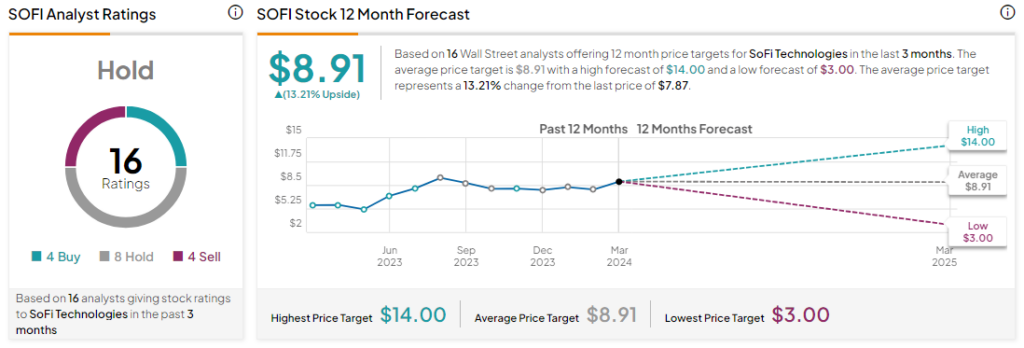

Analysts remain sidelined about SOFI stock, with a Hold consensus rating based on four Buys, eight Holds, and four Sells. Year-to-date, SOFI has declined by more than 20%, and the average SOFI price target of $8.91 implies an upside potential of 13.2% from current levels. These analyst ratings are likely to change following the announcement of SOFI’s results today.