SLB (NYSE:SLB) announced better-than-expected Q1 revenues of $8.71 billion, surpassing analysts’ expectations of $8.7 billion and marking a 13% year-over-year increase. The growth was predominantly driven by its international business, which witnessed a significant revenue surge of 18% year-over-year to reach $7.06 billion.

The oilfield services company reported adjusted earnings of $0.75 per share, marking a 19% year-over-year increase and aligning with consensus estimates.

In addition, the company’s Board of Directors approved a quarterly cash dividend of $0.275 per share of common stock, payable on July 11 to shareholders of record on June 5, 2024.

Looking ahead to FY24, SLB has forecasted its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to grow in the mid-teens. For the second quarter, the company’s management expects a “seasonal rebound” in activity in the Northern Hemisphere and strong international performance. This is likely to drive a margin expansion across all its businesses.

Building on a strong start to FY24 and its recent $8 billion acquisition of ChampionX Corp (NASDAQ:CHX), SLB is targeting shareholder returns of $7 billion over the next two years. This plan involves targeting shareholder returns of $3 billion in 2024 and $4 billion in 2025.

Is SLB a Good Stock to Buy?

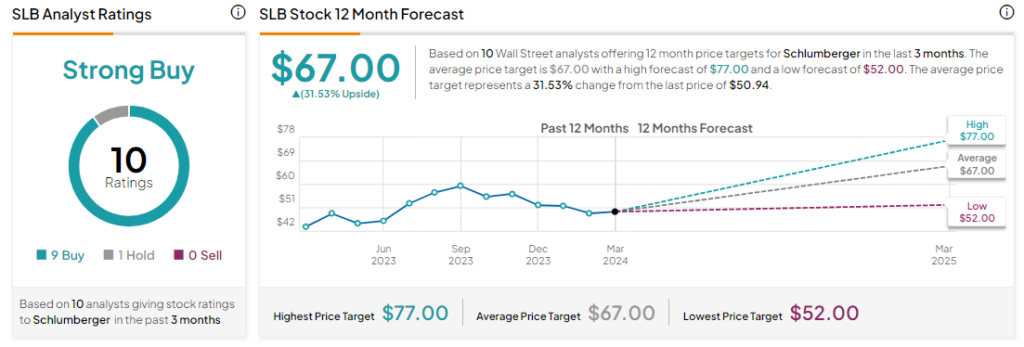

Analysts are bullish about SLB stock, with a Strong Buy consensus rating based on nine Buys and one Hold. Year-to-date, SLB has declined by 1.5%, and the average SLB price target of $67 implies an upside potential of 31.5% from current levels. However, these analyst ratings are likely to change following SLB’s results today.