Starbucks Corporation (NASDAQ:SBUX) reported lower-than-expected Q2 sales and EPS. In addition, the company significantly lowered its EPS growth forecast for Fiscal 2024, citing near-term headwinds. This irked investors, triggering an 11.6% drop in SBUX stock during Tuesday’s after-hours trading.

The company, which operates a chain of coffeehouses and retails specialty coffee, is facing macro and geopolitical headwinds, which are impacting traffic and, in turn, its financial performance.

Starbucks Missed Q2 Expectations

Starbucks delivered consolidated net revenue of $8.6 billion in Q2, down 2% year-over-year. This decline reflects a 4% decrease in its global comparable (comps) store sales, reflecting a 6% drop in comparable transactions. The company’s revenues fell short of analysts’ expectations of $9.12 billion.

SBUX’s adjusted operating margin contracted 150 basis points year-over-year. The decrease was due to lower sales, higher promotional activities, and increased general and administrative costs, partially offset by improved pricing and in-store operational efficiencies.

The year-over-year decline in sales and margins weighed on its bottom line. Starbucks reported adjusted EPS of $0.68, down 8% year-over-year. Further, its EPS missed the Street’s forecast of $0.80.

Weak Outlook

Starbucks’ management acknowledged that the company is facing near-term sales and margin headwinds, which led it to cut its full-year guidance.

The company expects its Fiscal 2024 global revenue to increase by the low single digits, down from its earlier growth guidance of 7-10%. Global and U.S. comps are likely to stay flat or decrease by low single-digit percentages. Previously, Starbucks expected its Global and U.S. comps to increase by 4% to 6%.

Given the slowdown in sales and margin headwinds, Starbucks projects its adjusted EPS to stay flat or increase by low single digits. This compares unfavorably to its earlier growth outlook of 15% to 20%.

Is Starbucks Stock a Buy, Sell, or Hold?

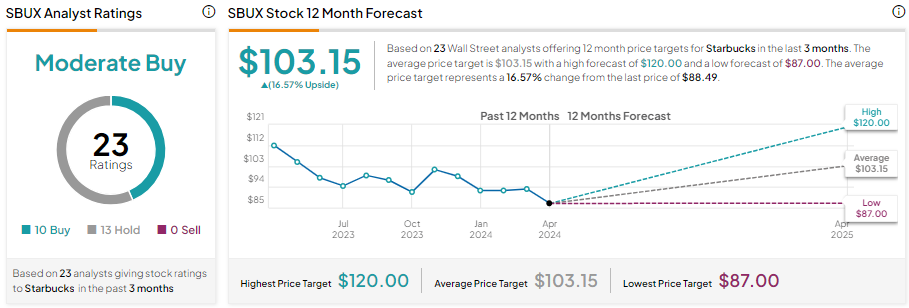

Starbucks stock is down about 7.3% year-to-date. Meanwhile, Wall Street remains cautiously optimistic about Starbucks’ prospects. It has 10 Buys and 13 Holds for a Moderate Buy consensus rating. Analysts’ average price target on SBUX stock is $103.15, which implies 16.57% upside potential from current levels.

It’s worth noting that the price targets on SBUX stock were set before the Q2 earnings report. This raises the possibility that SBUX stock might witness downward adjustments in price targets from analysts due to the weaker-than-expected Q2 earnings and guidance cut.