When Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) CEO Warren Buffett is buying a stock, that’s big news. Be careful, though, as it’s also important to take note of the times when Berkshire generally isn’t in a buying mood. Occidental Petroleum (NYSE:OXY) has its positive and negative points, but I am neutral on OXY stock as the Oracle of Omaha might not see irresistible value with Occidental Petroleum right now.

Occidental Petroleum is a U.S.-based producer of oil and natural gas. The company, like some other oil majors, is also delving into carbon-capture technology. However, for the foreseeable future, investors should expect Occidental Petroleum to mainly generate its revenue from oil and natural gas.

Value seekers and passive-income investors might assume that OXY stock is a must-own because Berkshire Hathaway made multiple purchases of the stock. Yet, investors should think about whether it makes sense to buy Occidental Petroleum shares under the present conditions and at Occidental’s current valuation. Sometimes, it’s best to just keep a stock on your watch list, even if the company is generally solid.

Is OXY Stock a Compelling Buffett-Style Investment?

There was a time, not too long ago, when Berkshire Hathaway kept on buying shares of Occidental Petroleum stock. However, Berkshire’s widely read annual shareholder letter suggests that Buffett has no particular interest in making a lot of new investments. This made me wonder, while doing my research, whether OXY stock really checks all of the important “Buffett boxes,” so to speak.

After reading Berkshire’s shareholder letter, we certainly might get the sense that Buffett doesn’t want to buy much of anything now. “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” Buffett wrote in the recently released Berkshire Hathaway annual shareholder letter.

Buffett also wrote about Occidental Petroleum specifically. He clarified that Berkshire Hathaway “has no interest in purchasing or managing” Occidental Petroleum (likely referring to purchasing the company outright or taking a stake large enough that the company can manage Occidental Petroleum).

Don’t get the wrong idea here. Berkshire Hathaway maintained a 27.8% stake in Occidental Petroleum at the end of last year. So, it’s not as if Buffett suddenly hates Occidental Petroleum.

Perhaps the feeling that OXY stock is a must-own asset just isn’t there for Buffett right now; it’s hard to tell at this point in time. Note that Occidental Petroleum has a trailing 12-month price-to-earnings (P/E) ratio of 15.4x, which is substantially higher than the sector median P/E ratio of 10.6x. Additionally, Occidental Petroleum has trailing 12-month price-to-sales (P/S) and price-to-book (P/B) ratios that exceed their respective sector medians.

Passive-income investors might also be disappointed since Occidental Petroleum only offers a forward annual dividend yield of 1.5%. That might seem decent, but energy companies often pay more than that. In fact, the energy sector’s average dividend yield is 3.752%.

Occidental Petroleum: Good Results, but Nothing Mind-Blowing

So far, we’ve explored some facts indicating that OXY stock isn’t a perfect Buffett pick right now. This doesn’t mean Occidental Petroleum is a terrible company by any means. Occidental Petroleum’s results for the fourth quarter of 2023 were pretty good, but don’t expect anything mind-blowing.

For the quarter, Occidental Petroleum’s revenue of $7.17 billion beat the consensus estimate of $6.84 billion. Furthermore, Occidental Petroleum reported adjusted earnings of $0.74 per share, surpassing Wall Street’s projection of $0.67 per share.

Those are pretty good Street beats, but we’re not looking at the type of blockbuster quarter that Nvidia (NASDAQ:NVDA) had, for example. Also, even though Occidental Petroleum exceeded analysts’ consensus sales forecast, there’s a bigger-picture issue to be aware of.

When I go to Occidental Petroleum’s financials page on TipRanks, I just don’t see long-term growth in the company’s revenue. I also don’t observe Occidental Petroleum making real headway in reducing the company’s net debt and total debt.

Of course, Buffett has the best tools available and is aware of the issues I’ve just mentioned about Occidental Petroleum. If his assessment confirms what the TipRanks tools indicate about Occidental Petroleum, then this may help to explain why Buffett and Berkshire Hathaway have no intention of buying out OXY now.

Is OXY Stock a Buy, According to Analysts?

On TipRanks, OXY comes in as a Moderate Buy based on seven Buys and eight Hold ratings assigned by analysts in the past three months. The average Occidental Petroleum stock price target is $67.60, implying 11.8% upside potential.

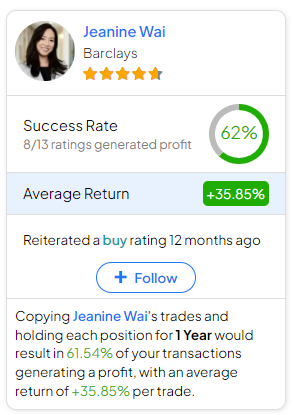

If you’re wondering which analyst you should follow if you want to buy and sell OXY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jeanine Wai of Barclays (NYSE:BCS), with an average return of 35.85% per rating and a 62% success rate. Click on the image below to learn more.

Conclusion: Should You Consider OXY Stock?

Buffett and Berkshire Hathaway surely had valid reasons for buying Occidental Petroleum stock last year. Circumstances change, though, and it’s unknown whether Buffett and Berkshire would want to buy Occidental Petroleum shares today, as they might not currently offer a favorable value-and-yield combination.

So, now you have an idea of why Buffett might or might not choose to add to his share stake in Occidental Petroleum today. Now, it’s time for you to conduct your own due diligence. As for me, however, I’m going to follow Buffett’s lead as it sounds like he’s not in the mood to do a lot of stock buying. Thus, I’m going to be highly selective, and I’m not considering buying OXY stock right now.