Despite a slowdown in consumer spending, paving expert Marshalls (GB:MSLH) reported a jump in its revenue and earnings in its half-year results for 2022.

The company maintained its full-year guidance numbers by betting big on its building products segment.

Marshalls remains optimistic about its acquisition of Marley Group, which was completed in April 2022. Marley is a leading manufacturer of roof tiles and the acquisition provides much wider coverage for the company in the construction market.

The cautious approach created worry among the shareholders, and the stock went down by 6.6%. The stock was the biggest faller on the FTSE 250 index on Thursday. Looking at the last year’s performance, the stock is down by 44.3%.

What is Marshalls in the UK?

Marshalls is a UK-based manufacturer and supplier of raw materials used by the construction, home interiors, and landscaping industries. It also supplies consumers directly.

The company has supplied its products to iconic British landmarks such as Trafalgar Square.

The company also provides design and installation services for gardens, driveways, and landscapes.

Results snippets

The company’s revenue increased by 17%, to £348 million. This was mainly driven by the company’s building products division, which reported revenue of £95.9 million, showing year-over-year growth of 21%.

The company’s landscaping products’ revenue was slightly down by 1% to £216.9 million. This segment was directly hit by the slowdown in consumer spending due to the cost-of-living crisis.

The company’s earnings (adjusted EBITDA) jumped by 14% to £64.2 million. On the flip side, pre-tax profits fell to £23.9 million from £38.9 million in 2021.

Marshalls increased its interim dividends by 21% to 5.7p per share, keeping it in line with its progressive dividend policy.

Is Marshalls a good stock to buy?

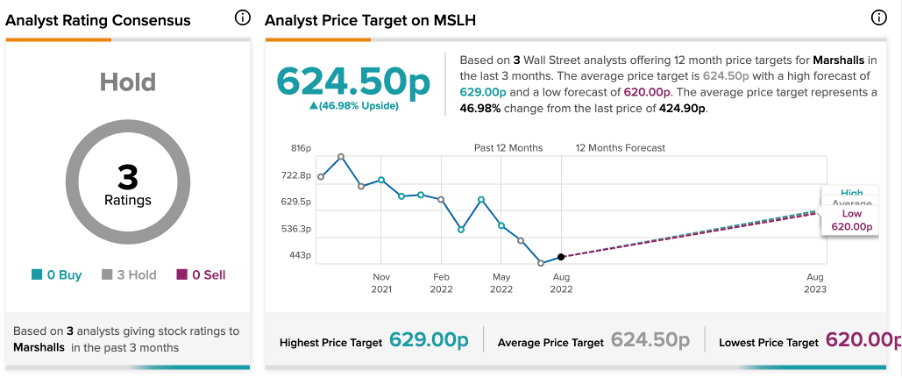

According to TipRanks’ analyst rating consensus, Marshalls’ stock has a Hold rating. The rating is based on three Hold ratings from analysts.

The MSLH price target is 624.5p, which is 46.9% higher than the current price level. The analyst price targets range from a low of 620p to a high of 629p.

Conclusion

Looking ahead, the company is aware of the macroeconomic challenges affecting the construction industry. Consumer spending is also down due to rising inflation, which poses a threat to its landscaping business.

However, the company expects to beat the challenges and is expecting to meet market expectations in its full-year results. Marshalls is optimistic about its building products segment delivering robust growth in the second half, supported its acquisition of Marley’s.