Normally, news about a proxy fight in the making doesn’t really thrill investors, but in Macy’s (NYSE:M) case, it sure seems to. The retailer’s internal battles for control of the board are firing up the base like no tomorrow, as Macy’s shares are up over 3.5% in Thursday morning’s trading session.

A coalition effort with Brigade Capital and Arkhouse Management is tooling up to take Macy’s private. They are now nearly in the due diligence phase. Some wondered if it would ever actually get this far, as the project had run into several weeks of delay. But it’s moving along, as Macy’s recently sent the activist investor a “draft confidentiality agreement.” With such an agreement in hand, Arkhouse will be able to get a look at Macy’s books and, from there, possibly make an offer for the company.

Previous bids of $21 per share were rebuffed, citing uncertain financing, but then Arkhouse raised its bid to $24 per share and pointed out some of its backers.

Out to Improve Operations and Online Advertising

Meanwhile, Macy’s is out to improve its operations and online advertising sales. It recently brought in a former Walmart (NYSE:WMT) executive in a bid to alter its business, closing around 150 stores and upgrading a handful of others to provide a more “premium” experience. But Macy’s is also doing brisk business with an advertising network, selling ad space on its website, among other things, and is looking to get a bigger slice of the pie. If it works, this move would mean more revenue.

Is Macy’s Stock a Buy, Sell, or Hold?

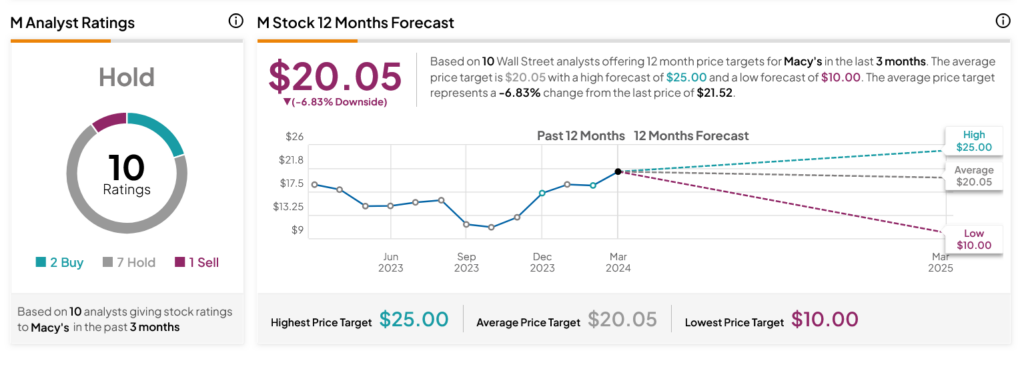

Turning to Wall Street, analysts have a Hold consensus rating on Macy’s stock based on two Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After an 18.43% rally in its share price over the past year, the average M price target of $20.05 per share implies 6.83% downside risk.