Shares of Lucid (NASDAQ:LCID) plummeted in after-hours trading after the EV company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at -$0.30, which missed analysts’ consensus estimate of -$0.25 per share. Sales increased by 15.6% year-over-year, with revenue hitting $172.74 million. This also missed analysts’ expectations by $9.7 million.

According to Lucid’s press release, the company delivered 1,967 vehicles in the quarter and claimed to be on track to manufacture 9,000 vehicles in 2024. Lucid ended the second quarter with approximately $5.03 billion in total liquidity.

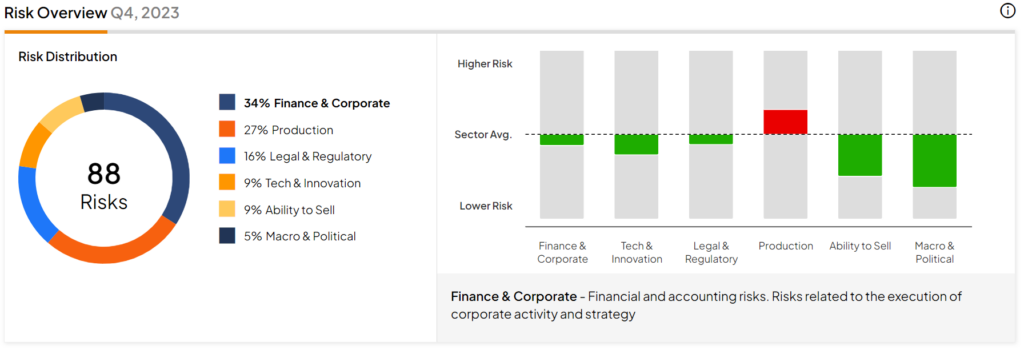

Despite the net loss, the management team is working to reduce costs as sales momentum “builds up.” Nevertheless, it will likely continue to burn cash for a while. In fact, the company discloses this as a risk in its filings, stating that it expects “to continue to incur substantial losses and increasing expenses in the foreseeable future.” Currently, Finance and Corporate is the category with the most risks for Lucid, as pictured below.

As a result, Lucid felt the need to raise an additional $1 billion during the first quarter through a private placement with an affiliate of the Public Investment Fund.

What Is a Good Price for LCID Stock?

Turning to Wall Street, analysts have a Hold consensus rating on LCID stock based on one Buy, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 60% decline in its share price over the past year, the average LCID price target of $3.21 per share implies 5.25% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.