Few companies have endured a sharper decline in their share prices since the pandemic than NIO (NYSE:NIO). The electric vehicle (EV) manufacturer has failed to deliver on great promises, and it’s arguable that its proprietary battery-swapping technology is no longer as useful as it once was, given the advances in charging technology. I’m no longer bullish on NIO stock, although I wouldn’t be surprised to see near-term volatility as investors digest production data and news.

Not Delivering on Promises

Around two years ago, I argued that NIO, considering its growth trajectory and valuation metrics, was among the best buys in the sector. The firm had been on something of a Tesla-esque (NASDAQ:TSLA) growth cycle. However, it underdelivered, partially due to supply chain constraints as China imposed prolonged COVID-19 restrictions, and it is continuing to do so.

In 2023, NIO delivered 160,038 vehicles, up 30.66% year-over-year. While that might sound like impressive growth, NIO delivered 91,429 vehicles in 2021, representing 109.1% year-over-year growth.

It’s clear that the pace of growth is slowing, while NIO’s peers are surging despite already being ahead in volume terms. Li Auto (NASDAQ:LI) reported that total deliveries in 2023 increased by 182.2% year-over-year to 376,030. Even Tesla, the market leader, was able to grow deliveries at a faster pace than NIO during 2023. Tesla’s deliveries grew by 38% during the year.

What’s more, NIO appears to be just as far from profitability as it was a few years ago. When I started covering NIO, the company was forecasted to turn its first profit in 2024-25. However, hitting breakeven has now been pushed back for at least another two years. If everything goes according to the forecasts, NIO may now turn a profit in 2027.

NIO’s debt has grown steadily over the past five years, reaching $4.5 billion. Meanwhile, NIO has around $8.1 billion in cash and cash equivalents, reflecting a runway of four years at the current burn rate. Given this runway and NIO’s plans to open 1,000 battery-swapping stations over the next year at an expected cost of around $420,000 each, the EV maker may be forced to raise more capital before cash flow turns positive.

Value Play Fading

NIO isn’t profit-making, and that makes establishing fair value a little more challenging. However, I certainly believe that NIO’s value play is fading. The company trades at 1.1x forward sales and has an enterprise-value-to-sales ratio of 1x.

While these aren’t unattractive figures, I believe NIO is fundamentally less attractive than Li Auto at 1.1x forward sales and 0.9x enterprise-value-to-sales. Of course, Li’s big selling point is the fact that it is profitable. Looking forward, NIO is trading at 24x forecasted earnings for 2027 – the first year it’s expected to turn a profit – while Li Auto is trading around 8.5x 2027 earnings.

Is NIO’s Unique Selling Proposition Still of Value?

NIO cars are fitted with swappable batteries, meaning that NIO owners can simply make their way to the company’s battery-swapping facilities and exchange their empty batteries for a full one in a matter of minutes. While this does mean that NIO has to develop its own battery-swapping station network, NIO owners have been able to go from empty to full much faster than Tesla owners, for example.

The only issue is that things are changing quickly. Charging times are falling, and Li Auto’s MEGA – the company’s first total battery electric vehicle – can be fully charged in just 12 minutes. This is exceptionally fast for the sector, and it’s indicative of the progress that is being made.

If we move towards an environment where all battery electric vehicles can be fully charged within 10 minutes, then investors will start to question the viability of having an expensive battery-swapping network for the sake of six-to-seven minutes per charge.

While NIO vehicles can be conventionally charged as well, it may be the case that NIO’s USP is becoming less important as the sector makes progress on charging times and range delivery. It is also reliant on Contemporary Amperex Technology Co. Limited (CATL) – the world’s largest EV battery maker — for its batteries.

In turn, I’d suggest NIO may struggle to make relative gains against its peers in terms of range and battery life, as most of the industry is also using CATL products. NIO recently announced that it was working with CATL to develop longer-lasting products.

Is NIO Stock a Buy, According to Analysts?

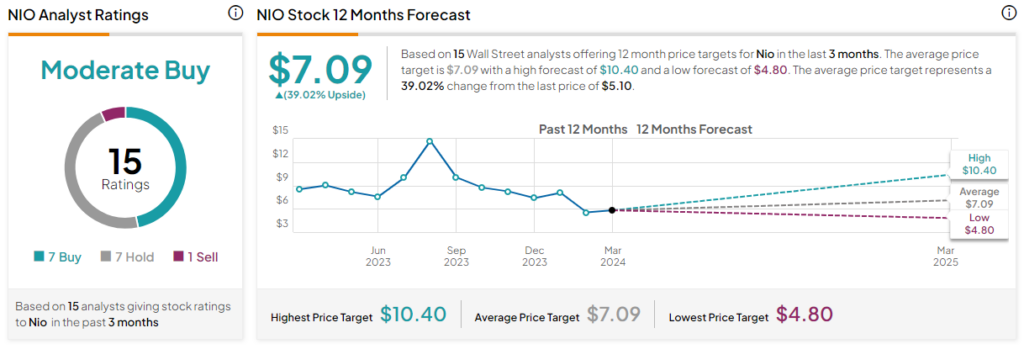

NIO stock comes in as a Moderate Buy, according to analysts. The EV stock has seven Buy ratings, seven Hold ratings, and one Sell rating. The average NIO stock price target is $7.09, indicating upside potential of 39% from current levels. The highest share price target is $10.40, and the lowest is $4.80.

The Takeaway

In short, while NIO has an interesting and attractive range of EVs, it’s looking less attractive from an investment perspective. Profitability is still far away, its unique selling proposition is fading, and growth is slowing.