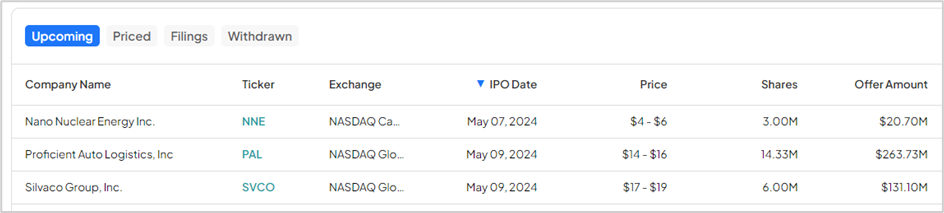

These are the upcoming IPOs (initial public offerings) for the week of May 6 to May 10, based on the TipRanks IPO Calendar. An IPO refers to the public market debut of a private company. Following the IPO, the company’s shares become available for trade (sale/buy) on the stock exchange.

There are several pros and cons for a company going public. The advantages include gaining the ability to raise capital, greater liquidity, and improved brand recognition. On the other hand, the company faces stringent financial reporting norms, is consistently in the public eye and answerable to shareholders, and experiences high costs related to maintaining compliance with regulatory requirements.

While 2023 turned out to be a lackluster year for capital markets and IPOs due to a high interest rate environment, experts anticipate that the IPO market will gain traction this year. With this background in mind, let’s look at the upcoming IPOs for this week.

Nano Nuclear Energy Inc.

Nano Nuclear Energy is a pre-revenue, development stage, advanced technology-driven company with four business verticals: portable microreactor technology, nuclear fuel fabrication, nuclear fuel transportation, and nuclear industry consulting services.

Nano Nuclear Energy is expected to be listed on the Nasdaq stock exchange under the ticker symbol NNE, on the estimated date of May 7, 2024. The company is set to issue 3 million shares for a price range of $4 to $6 per piece, which means Nano Nuclear could raise between $12 to $18 million in capital with the issue.

As per Nano Nuclear’s offering, the company will use the majority of the proceeds for research and development (R&D), design optimization, test work, and scoping studies. The rest will be directed toward marketing, working capital, and general corporate purposes.

Proficient Auto Logistics, Inc.

Proficient Auto Logistics operates in the automotive transport industry with over 150 trucks. The company provides finished vehicle logistics services to all 48 states, with a vast customer base spanning major OEMs (Original Equipment Manufacturers), rental car companies, auctions, finance companies, and dealerships.

As per the Form S-1 filing, Proficient Auto Logistics is expected to list on the Nasdaq stock exchange under the ticker symbol “PAL” on May 9. The company is offering 14,333,333 shares of its common stock at a price band of $14.00 to $16.00 per piece.

The company aims to raise roughly $195.2 million ($215 million gross proceeds) from the IPO at the midpoint of the estimated price band. Most of the net proceeds will be used to pay the cash portion of the consideration related to the acquisition of five operating businesses (Delta Automotive Services, Deluxe Auto Carriers, Sierra Mountain Group, Proficient Auto Transport, and Tribeca Automotive) and their respective affiliated entities.

Silvaco Group, Inc.

Silvaco operates in the semiconductor space, offering affordable and competitive TCAD (Technology Computer Aided Design) software, EDA (Electronic Design Automation) software, and proven design IP (intellectual property). Silvaco’s products are used across several industries, including display companies, automotive OEM suppliers, and top Memory, 5G, and IoT (Internet of Things) providers.

Silvaco is estimated to list 6 million shares of its common stock on the Nasdaq stock exchange under the ticker symbol “SVCO” on May 9. The company’s price band for the listing is set between $17 and $19 per share. It expects to raise approximately $108 million at the estimated midpoint. The net proceeds will be used for general corporate purposes.