Shares of Inmode (NASDAQ:INMD) are slightly lower at the time of writing after the maker of minimally-invasive aesthetic medical products reported its Q1 results and announced buybacks. Adjusted earnings per share came in at $0.32, which missed analysts’ consensus estimate of $0.44 per share. However, when adjusted to include pre-orders, EPS rose to $0.45. Still, both figures are below the $0.52 per share from the year-ago period.

Sales decreased by 24.3% year-over-year, with revenue hitting $80.28 million. This was $11.1 million below expectations. When adjusting for pre-orders, sales came in at $96.01 million.

Inmode also finally announced buybacks, after its CEO Moshe Mizrahy had refused to do so over the past few quarters. Investors had been pushing the company to repurchase shares for months, even going as far as voting Mizrahy out as Chairman of the Board. However, the buyback amount of 8.37 million shares, which equates to roughly $142 million based on current prices, wasn’t enough to impress investors, especially when considering the company’s cash pile of more than $770 million.

Inmode’s guidance didn’t help either, as management now expects revenue and adjusted EPS for 2024 to be in the ranges of $485 million to $495 million and $2.01 to $2.05, respectively. For reference, the company had previously guided for revenue of $495 million to $505 million and an EPS range of $2.53 to $2.57.

Is INMD Stock a Good Buy?

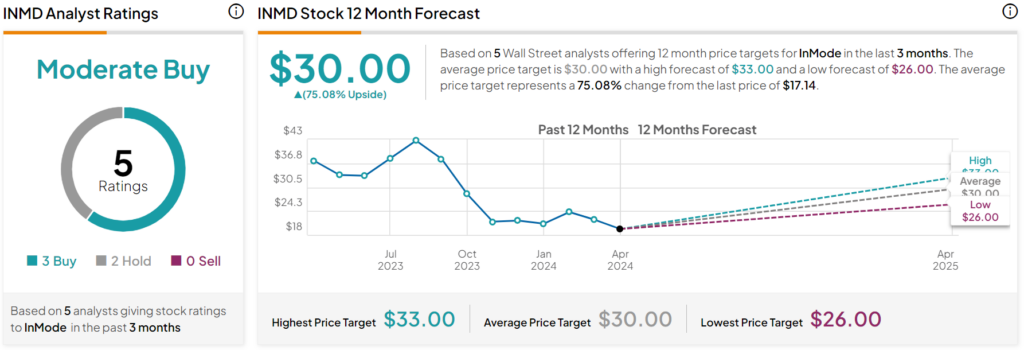

Turning to Wall Street, analysts have a Moderate Buy consensus rating on INMD stock based on three Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 50% decline in its share price over the past year, the average INMD price target of $30 per share implies 75% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.