In major news on UK stocks, Lloyds Banking Group PLC (GB:LLOY) reported a 28% decline in its profits due to the easing of interest rate tailwinds in the UK economy. The FTSE 100-listed bank posted a statutory pre-tax profit of £1.6 billion, compared to £2.3 billion a year ago.

Despite this decline, investors responded positively to the Q1 numbers, after the bank reaffirmed its full-year guidance. Moreover, Lloyds reported a net interest margin of 2.95% for Q1, slightly surpassing the expectation of 2.93%. Lloyds stock gained 3% today, as of writing.

Lloyds Banking Group is one of the UK’s oldest and largest banks, providing a wide range of financial services.

Insights from Lloyds’ Q1 Performance

Lloyds’ underlying net interest income declined by 10% to £3.2 billion, impacted by higher competition in the savings and mortgage segments and a reduced interest margin. The net interest margin was down from 3.22% in Q1 2023 to 2.95% reported in this quarter. The bank confirmed its expectation for the margin to exceed 2.90% for the full year, as compared to the current consensus estimate of 2.93%.

Over the last two years, UK banks have gained a huge advantage from the rising interest rates in the economy to curb inflation. Yet, competition in the savings and mortgage markets, along with expectations of rate cuts, has dampened interest margins.

William Chalmers, Lloyds’ CFO, stated that the bank maintains its expectation of three base rate cuts by the Bank of England, with the first one anticipated around the middle of the year.

Analyst Alex Wong from Third Bridge believes that to counter the margin decline, the bank must adopt a cross-sell strategy to increase the customer’s wallet share. Experts recommend achieving an average of 2.6 products per customer in the short term so that Lloyds is well-positioned to meet its 2026 targets.

Is Lloyds a Good Stock to Buy?

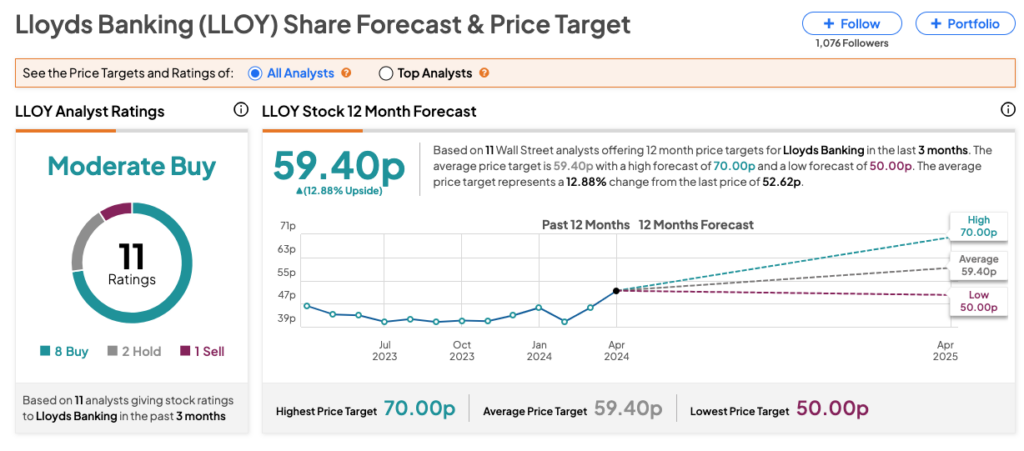

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on 11 recommendations, of which eight are Buy. The Lloyds share price target is 59.40p, which reflects about 13% upside potential in the share price.