In major news on UK stocks, shares of the FTSE 250-listed Abrdn PLC (GB:ABDN) fell after the asset manager reported a 35% jump in its net outflows in its 2023 results. For the full year, the company’s outflows increased to £13.9 billion from £10.3 billion in 2022. Abrdn also cautioned about the pressure on margins to continue in 2024 as more and more customers look for affordable options.

Abrdn shares retreated from early gains of around 7% and are currently trading down by about 3%.

Resilient Performance Amid Challenges

Abrdn reported a pre-tax loss of £6 million for 2023, which was significantly lower than the £612 million loss reported a year ago. Additionally, the adjusted operating profits stood at £249 million, surpassing forecasts, but lower than the £263 million recorded in 2022.

The net operating revenue amounted to £1.4 billion, reflecting a 4% decrease over last year, mainly due to the challenging market conditions in the company’s investment business. The net outflows for the investment business amounted to £15.3 billion (excluding LBG and liquidity), compared to £13.4 billion in 2022. However, revenue increases were observed in both Adviser and ii (interactive investor) businesses, partially offsetting the decline.

On the plus side, the company surpassed the £75 million cost reduction target, achieving a reduction in expenses of £102 million in 2023. The company’s transformation program targets £150 million in annualized cost cuts by 2025, with 80% savings benefiting its investment business.

The company announced a final dividend of 7.3p per share, maintaining its total dividend similar to last year at 14.6p.

What is the Forecast for Abrdn Shares?

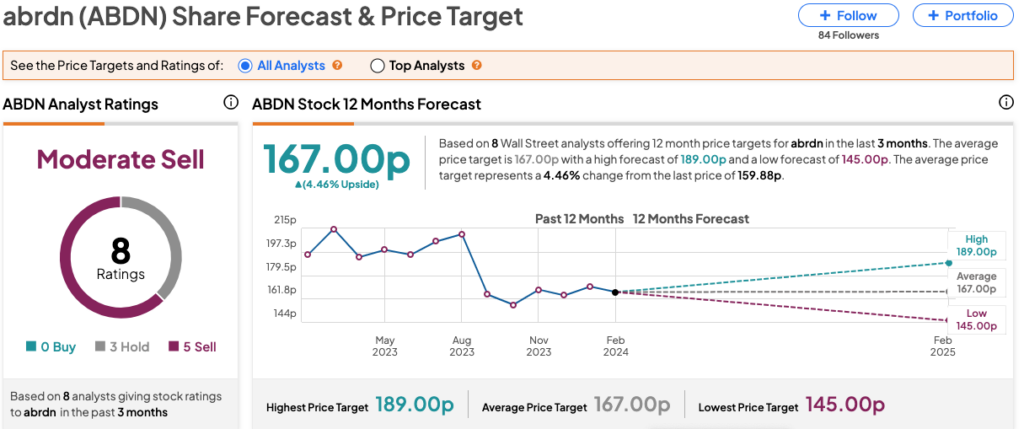

Analysts are adopting a cautious stance on the company’s share price trajectory due to prevailing challenges in the industry. Consequently, ABDN stock has a Moderate Sell rating on TipRanks, backed by five Sell and three Hold recommendations. The Abrdn share price forecast is 167.0p, which is 4.46% above the current price level.