The share price of TUI AG (DE:TUI1) gained 15.3% yesterday after the company delivered a stellar performance in Q4 and FY23. The travel company witnessed strong demand in all its core businesses and expects the trend to continue in the next year. Moreover, it benefited from the consolidation of its products onto a unified global platform implemented last year.

Along with the results, the company’s board sparked additional interest by saying that it is contemplating delisting from the London Stock Exchange and opting for a single German listing. This move could be a setback to the UK market, which is already seeing a lot of companies shifting their listings to alternative markets.

Based in Germany, TUI Group operates as a prominent player in the tourism and leisure industry. The company offers an extensive range of travel and holiday services across major destinations globally.

Strong FY23 Figures and a Promising Forecast

In FY23, revenues grew by 25% on a year-over-year basis to €20.7 billion. The company’s underlying EBIT more than doubled to €977 million from €409 million in 2022. A total of 19.1 million guests travelled with the company in 2023, compared to 16.7 million in 2022, reflecting huge demand for its services.

Bookings for the ongoing winter 2023/24 season reflect positive momentum, showing an 11% increase compared to the previous year. Approximately 56% of the winter program has been sold, with a 5% increase in average prices in the core markets.

In terms of outlook, the company anticipates at least a 25% increase in its underlying operating profit for FY24. The company expects at least 10% growth in its FY24 revenues. The projected growth indicates that despite inflationary pressures, the surge in post-pandemic travel is still going well.

What is the Prediction for TUI Stock?

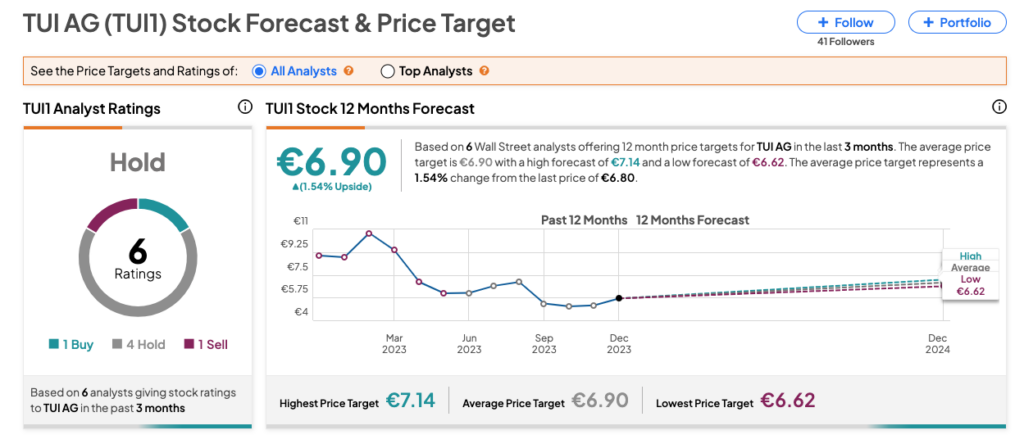

Despite the robust growth numbers, analysts have not given their unanimous approval. Following the release of results, analysts have maintained their mixed ratings on the stock and are not predicting significant growth in the share price.

Analyst Mark Irvine from Stifel Nicolaus maintained his Hold rating on the stock yesterday, predicting around 2.8% growth.

According to TipRanks, TUI1 stock has a Hold rating based on one Buy, four Holds, and one Sell recommendation. The TUI share price target of €6.90 implies a modest growth of around 1.5%.

Year-to-date, the stock is trading down by over 18%.