SGX-listed Keppel Limited (SG:BN4) announced impressive full-year Fiscal 2023 results last week and earned analysts’ Strong Buy consensus rating. Analysts expect the Singapore-based asset manager to deliver solid upside and enhance shareholder returns with high dividends.

Keppel has operations in over 20 countries and is focused on infrastructure, real estate, and connectivity areas.

Analysts Bullish on Keppel’s Growth Potential

Keppel’s net profit quadrupled to S$4.1 billion in Fiscal 2023, thanks to a S$3.3 billion gain from the divestment of the company’s Offshore and Marine business. Excluding one-time items, the company’s net profit from continuing operations increased 19% to S$996 million.

Moreover, Keppel announced a final cash dividend of S$0.19 per share, with the total dividend for Fiscal 2023 standing at S$0.34 per share and reflecting a yield of about 5%. Including a special dividend payment, Keppel shareholders will be rewarded with total dividends of S$2.70 per share.

On Friday, UOB Kay Hian analyst Adrian Loh reiterated a Buy rating on Keppel stock but lowered the price target to S$8.89 from S$9.09 to reflect the modestly higher share count and lower valuation of the company’s property segment.

Loh noted that KEP’s upbeat Fiscal 2023 results were driven by the strong performance of its Infrastructure and Connectivity segments. In particular, he highlighted that the 135% rise in the net profit of the Infrastructure segment indicates that its mid-to-high-teens profit margins are sustainable.

The analyst expects asset monetization and capital recycling to drive Keppel’s share price higher, given the possibility of a more active M&A market this year.

Likewise, CGS-CIMB analyst Lim Siew Khee reiterated a Buy rating on Keppel shares and increased the price target to S$8.98 from S$7.15 to reflect higher Infrastructure segment profits and private funds.

Khee highlighted that Keppel’s recurring income surged 54% to S$773 million in FY23, with the Infrastructure business being the largest contributor of recurring earnings among all the businesses.

The analyst believes that Keppel’s acquisition of Aermont Capital has lifted its position in the global asset management market, making way for additional earnings-accretive platform deals as Keppel aims to achieve its target of funds under management (FUM) of S$200 billion by 2030.

What is the Target Price for Keppel?

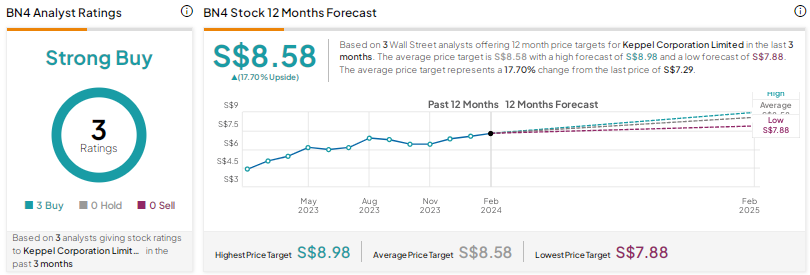

With three unanimous Buys, BN4 stock earns a Strong Buy consensus rating on TipRanks. The average Keppel share price target of S$8.58 implies about 18% upside potential. Keppel shares have rallied nearly 56% in the past year.

Conclusion

Keppel delivered strong results in FY23 despite a tough macro backdrop. Analysts are bullish about the road ahead and are optimistic about the company’s Infrastructure business driving further growth. As per TipRanks’ Smart Score System, Keppel shares earn a Smart Score of nine out of 10, reflecting their ability to generate market-beating returns over the long term.