FTSE 100-listed retail companies Next PLC (GB:NXT) and JD Sports Fashion PLC (GB:JD) reported impressive profit figures in their latest earnings report today. Both companies displayed strong financial performance, driven by higher sales amid a difficult economic landscape. The market has responded favourably to these figures, driving up the share prices of both companies. At the time of writing, the Next share price has surged by over 3%, while JD Sports’ stock has seen a substantial increase of more than 6%.

The TipRanks Earnings Calendar tool offers a systematic way to track companies that have recently released their earnings reports. Investors can leverage this resource to delve deeper into these stocks, enhancing their decision-making capabilities.

Let’s dig deeper into the numbers.

Next PLC Results 2023

Next is a well-known UK retail brand, specializing in clothing, footwear, and other home products. The company conducts its operations through physical retail stores as well as online channels.

In its first-half earnings report for FY23 that ended on July 30, statutory sales of £2.52 billion grew by 5.8%, compared to £2.38 billion a year ago. The pre-tax profits increased by 4.8% to £420 million. The company attributed the profits to improved sales figures in May and June due to warmer weather and reduced cost pressures.

The company also revised its full-year guidance numbers and now expects its full-year pre-tax profits to be £875 million, compared to the previous forecast of £845 million. Additionally, the company anticipates full-price sales of £4.72 billion, indicating 2.6% year-on-year growth.

Is NXT a Good Stock to Buy?

NXT stock has received a Moderate Buy rating on TipRanks, backed by a total of nine recommendations. The Next share price target is 7,281.0p, which is similar to the current trading levels.

Year-to-date, the stock has gained around 24% in trading.

JD Sports H1 2024 Results

JD Sports is a prominent British retail company focused on sports and fashion brands. The company provides an extensive collection of renowned global brands, including Nike, Adidas, Puma, and others, in addition to featuring its own brand labels, such as Pink Soda and Supply & Demand.

The company’s pre-tax profits for the first half of fiscal year 2024 increased by 25.8% to £375 million, up from £298.3 million reported last year. Revenue grew by 8.3% to £4.78 billion and surpassed the analyst consensus of £4.74 billion. The company’s numbers reflected its robust performance in North America, its success in gaining market share in crucial markets, and the strategic divestment of non-core assets in the UK.

For the full fiscal year ending in February 2024, the company has reaffirmed its guidance of achieving a headline pre-tax profit of £1.04 billion.

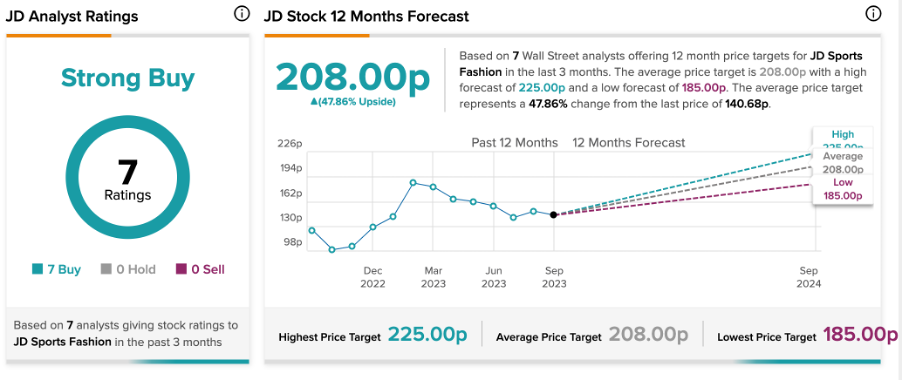

Are JD Sports Shares a Good Buy?

According to TipRanks’ consensus, JD stock has been rated a Strong Buy based on all Buy recommendations from seven analysts. The JD Sports share price prediction is 208.0p, which is 47.9% above the current level.