Shares of the ASX-listed Rio Tinto Limited (AU:RIO) are going through a tough time, with a year-to-date loss of almost 12%. The share price mainly reflects the company’s mixed results for 2023, volatile commodity prices, and an uncertain environment in China. However, analysts maintain a moderately bullish outlook on the stock and expect a decent upside in the next 12 months.

Rio Tinto is a well-known mining company involved in the exploration, extraction, and processing of minerals. The company owns a portfolio of eight commodities and has operations in around 18 countries.

Mixed Results for 2023

In its annual results for 2023, Rio Tinto reported a 3% year-over-year decline in full-year revenue to $54 billion despite a 3% increase in production. The higher volumes were offset by reduced commodity prices, particularly for aluminum. As a result, the underlying EBITDA was down by 9% to $23.9 billion in 2023, compared to the last year.

Rio Tinto’s full-year dividend also decreased by 12% to $4.35 per share, but, the payout ratio of 60% remained at the top of the guidance range of 40%-60%.

Volatile Share Price

The share price of mining companies is heavily reliant on the prices of the commodities they specialize in. In the case of Rio Tinto, most of its profits are derived from iron ore, making it highly dependent on this commodity. Iron ore prices, however, are predominantly driven by the demand in China, which is uncertain given the challenging economic conditions in the country.

On the bright side, RIO is currently developing the Simandou iron ore project in Guinea, Africa, and the Oyu Tolgoi underground copper mine in Mongolia, aiming to build a more reliable portfolio. Additionally, the company has achieved its initial sustainable production in Mongolia and aims to produce 500,000 tonnes of copper annually from 2028 to 2036.

Is it Good to Buy Rio Tinto Shares?

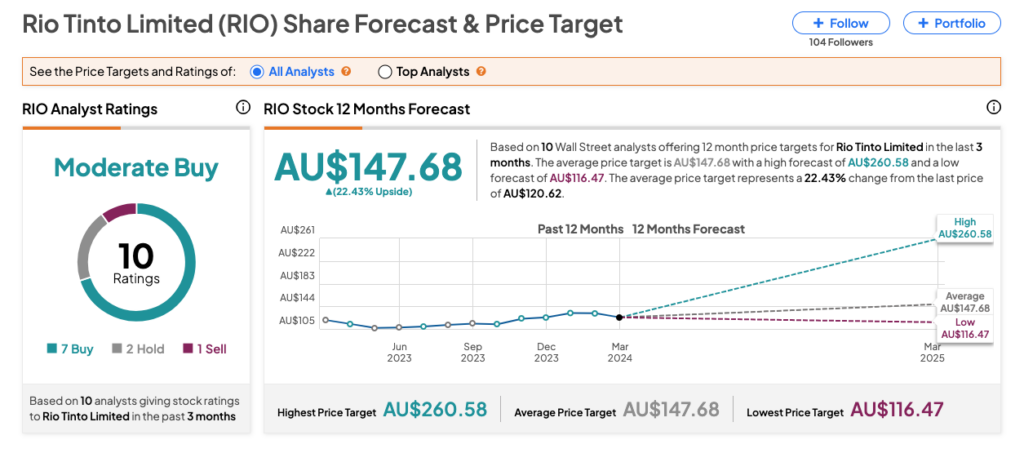

According to TipRanks, RIO stock has received a Moderate Buy consensus rating based on a total of 10 recommendations, of which seven are Buy. The RIO share price forecast is AU$147.68, which is 22.4% above the current trading level.