Using the Top Dividend Shares tool for the UK market, we have shortlisted two companies offering good dividend payments. abrdn PLC (GB:ABDN) and B&M European Value Retail SA (GB:BME) are prominent market players known for their reliable dividend payouts over the years. However, in the last few years, these companies have slashed their dividend payments after struggling with higher costs that hurt profits.

According to analysts, these stocks don’t offer much growth in terms of share price growth but are still attractive choices for income investors.

Let’s take a look at these companies in detail.

abrdn PLC

abrdn is a global investment firm that assists clients in saving and investing for their future. The company manages around £500 billion in assets with its three core segments – Investments, Adviser, and Personal.

After facing a challenging period in its share price over the last three years, the company’s stock has recovered a bit after gaining 11.6% in the last year.

The company has a dividend yield of 7.13%, which is above the sector average of 3.91%. For the last three years, the company has fixed its dividend at 14.6p per share. Analysts expect a slight decrease in dividends to 14.1p per share in 2023. However, even with this reduction, it is among the top dividend payers in the UK market.

Is ABDN a good buy?

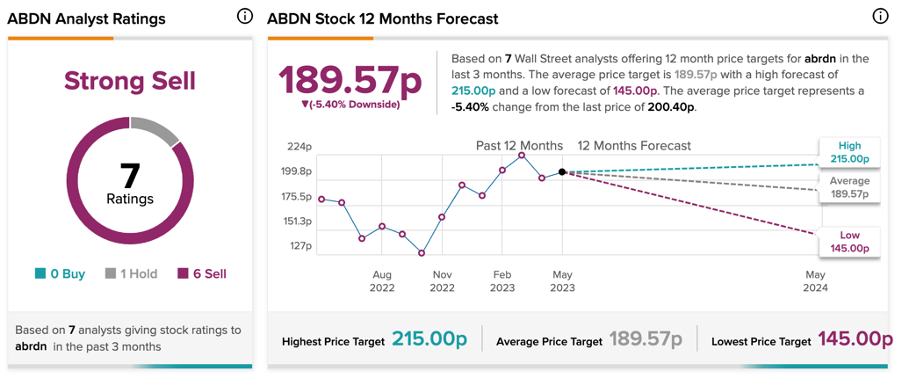

According to TipRanks, ABDN stock has a Strong Sell rating based on six Sell and one Hold recommendations.

The average price forecast is 189.57p, which implies a downside of 5.4% from the current trading levels.

B&M European Value Retail S.A.

B&M is a UK-based retailer offering a wide range of general products and grocery items at affordable prices.

Yesterday, the company released its 2023 earnings report, where it posted a 6.6% increase in revenues to £4.98 billion. However, the full-year pre-tax profits were down by 17% to £436 million, as compared to £525 million reported a year ago. This was mainly driven by higher operating costs, which increased by 5.7% during the year.

Due to decreased profits, the company made the decision to reduce its final dividend by 17% to 9.6p per share. Consequently, the total dividends for the company amounted to 14.6p, down from the previous year’s payment of 16.5p. The company’s dividend yield stands at 3.5%.

Nevertheless, analysts perceive this as a temporary situation, as the company maintains an optimistic outlook for its performance in the financial year 2024. The company has already started 2024 on a positive note, with LFL (like-for-like) sales up by 8.3%.

What is the Prediction for B&M’s Share Price?

Based on three Buy, one Hold, and one Sell recommendations, BME stock has a Moderate Buy rating. The average price prediction of 492p suggests a decline of 5.37% in the share price.

Conclusion

In recent years, these companies have reduced their dividend payments due to challenges associated with increased costs, which have adversely affected their profitability. Analysts feel these stocks still remain appealing for income investors in the UK market.