Buying top-rated stocks near their 52-week low is often associated with value investing. To identify such undervalued stocks, we have leveraged TipRanks’ Stock Screener tool and zeroed in on Five Below (NASDAQ:FIVE). FIVE stock, a specialty discount store operator, is temporarily out of favor in the market. However, analysts endorse this company.

Is Five Below a Good Investment?

Shares of Five Below are down over 33% year-to-date and are trading near the 52-week low of $140.19. The company’s lower-than-expected full-year comparable sales guidance and inventory shrink issues dragged its stock lower.

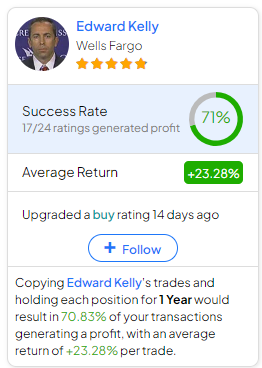

Nonetheless, Wells Fargo analyst Edward Kelly upgraded FIVE stock to Buy on April 25, citing favorable risk/reward. Moreover, the five-star analyst has a price target of $180 on FIVE stock, implying 26.67% upside potential from current levels.

Kelly is also the most accurate analyst on FIVE stock. Copying Kelly’s trades and holding them for a year would give you an average return of 23.28%, with 71% of your trades generating a profit.

Overall, FIVE stock has 11 Buys, and three Holds for a Strong Buy consensus rating. Analysts’ average price target on FIVE stock is 206.43, implying 45.27% upside potential from current levels. Moreover, FIVE’s forward price/earnings and enterprise value/sales multiples of 24.31 and 2.32, respectively, are well below the five-year historical average.

Bottom Line

The most accurate analyst recommending a Buy on FIVE stock might be seen as a positive indicator. However, it’s important for investors to consider multiple parameters when making investment decisions. This is where TipRanks’ tools like Stock Screener can be invaluable, providing a comprehensive view to make informed investment decisions.