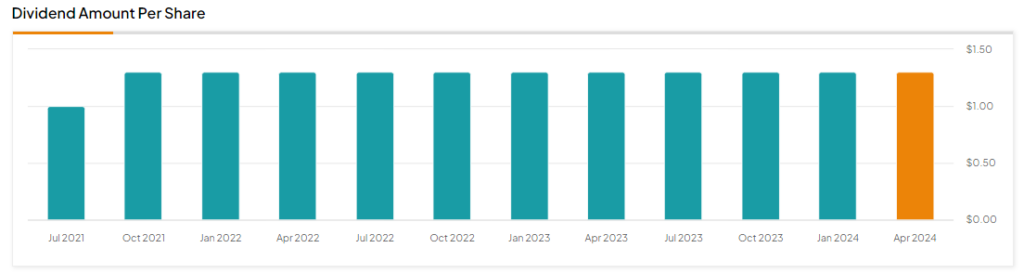

Cracker Barrel Old Country Store (NASDAQ:CBRL) plunged in trading after the company slashed its quarterly dividend by more than 80% to $0.25 per share from its prior dividend of $1.30, as indicated by the graphic below. The new quarterly dividend will be payable on August 6 to shareholders of record as of July 19, 2024.

Cracker Barrel’s Strategic Transformation Plan

In addition, the chain of restaurants and gift stores revealed a strategic transformation plan as it aims to focus more on growing its business. The company’s strategic transformation plan is built on five pillars, including refining the brand, innovating its menu, and delivering an exceptional guest experience. CBRL also intends to grow its off-premise business using technology like Cracker Barrel Rewards to drive engagement through guest data. Moreover, the company plans to enhance training, simplify roles, and use technology to improve the work environment for employees.

Update on CBRL’s Financial Results

Cracker Barrel is expected to announce its fiscal Q3 results on May 30. The company stated that it expects its fiscal Q3 and Q4 results to be below its prior forecasts, primarily due to “weaker-than-anticipated traffic.”

Over the long term, the restaurant chain anticipates FY27 sales of $3.8 billion to $3.9 billion and adjusted EBITDA between $375 million and $425 million. Furthermore, CBRL estimates that its FY25 adjusted EBITDA will be similar to or slightly lower than FY24 results, with improvement in late 2026 and acceleration in 2027.

Additionally, the company expects FY25 to be an “investment year,” with capex between $160 million and $180 million.

Is CBRL Stock a Buy?

Analysts remain sidelined about CBRL stock, with a Hold consensus rating based on one Buy, five Holds, and two Sells. Year-to-date, CBRL has plunged by more than 20%, and the average CBRL price target of $72.50 implies an upside potential of 26.6% from current levels.