Palantir (NYSE:PLTR) has seen its stock climb by 225% over the past year, setting lofty expectations ahead of its earnings release yesterday. Although the big data analytics company reported strong growth for Q1, it was not enough to meet these heightened investor expectations. As a result, shares plummeted by 15% today.

The company, known for its AI-driven solutions tailored for governments and corporations, achieved a record profit of $106 million in Q1 – its highest to date. Revenue for the quarter rose 21% year-over-year to $643.3 million, surpassing Wall Street forecasts of $615.3 million. EPS matched analyst expectations at $0.08.

Coming off its growing revenues, Palantir also raised its guidance for the rest of 2024. Total revenues for FY2024 are now projected to range between $2.667 billion and $2.689 billion. However, these numbers fell short of the $2.71 billion the Street was looking for.

Slowing international sales, which fell by 3% from the previous quarter, also scared off investors. Specifically, dim prospects for growth in Europe, which accounts for 16% of the company’s business, negatively impacted the numbers.

In light of these factors, what’s the next move for investors? Wedbush analyst Daniel Ives suggests that the recent dip in stock price may present a valuable buying opportunity for those looking to invest in PLTR.

“We are laser focused on the AI story playing out with AIP (Artificial Intelligence Platform) leading the way and Palantir delivered robust numbers on this front yet again,” writes Ives. In fact, the lower stock price presents a “golden buying opportunity for this pure play AI name.”

Ives likes what he sees, especially from Palantir’s growing cadre of clients and shortening sales cycles. With a total customer count of 554 (up 42% year-on-year) and faster conversion rates, the analyst optimistic about the company’s ability to sustain its growth trajectory.

“We continue to see increased momentum in the PLTR growth story with AIP leading the charge in generating significant demand across both commercial and government landscapes while wellpositioned to gain a larger share of this $1 trillion opportunity taking place with AI use cases exploding globally,” Ives summed up.

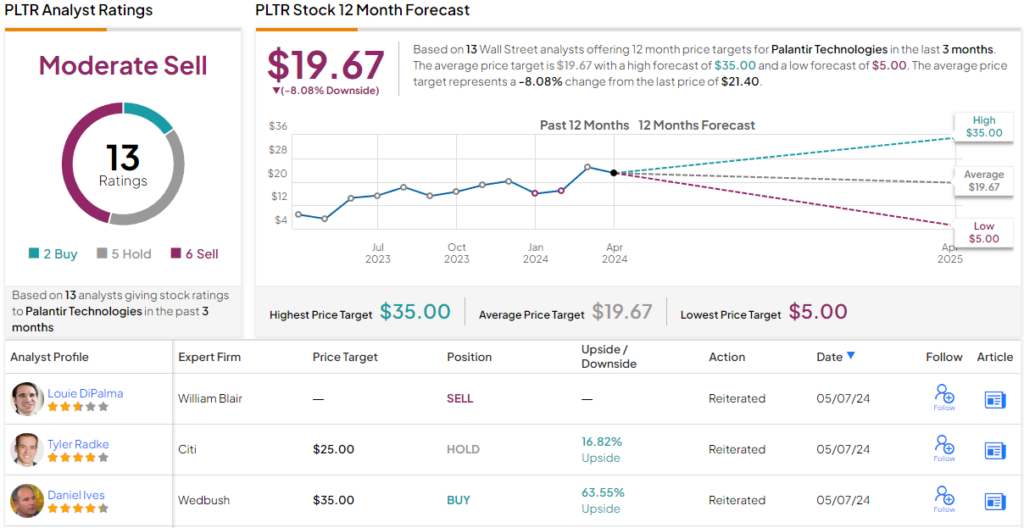

Not surprisingly, Ives rates PLTR shares as an Outperform (i.e. Buy), along with a $35 price target, which represents ~64% upside potential for the next 12 months. (To watch Daniel Ives’ track record, click here)

However, Ives’ colleagues aren’t quite as upbeat. Based on 6 Sells, 5 Holds, and 2 Buys, PLTR has a Moderate Sell consensus rating. At $19.67, the average price target implies an 8% downside from the current share price of $21.40. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.