Bloom Energy (NYSE:BE) shares surged nearly 17% in the morning session today after the energy solutions provider delivered a better-than-anticipated third-quarter performance and reaffirmed its outlook for the full year.

During the quarter, revenue jumped by 36.9% year-over-year to $400.3 million, exceeding estimates by nearly $31.3 million. Importantly, EPS of $0.15 outpaced expectations by a wide margin of $0.19. The growth in the company’s top line was led by robust gains in Product and Service revenue.

The company’s energy servers are gaining traction due to their quick deployability. Additionally, the combination of Bloom’s energy servers and CHP (Combined Heat and Power) solution is proving to be a strength for data center cooling and carbon capture requirements in the marketplace.

Looking ahead to Fiscal year 2023, Bloom has reaffirmed revenue expectations of between $1.4 billion and $1.5 billion. Product and Service revenue for the year is anticipated to be between $1.25 billion and $1.35 billion. Amid a focus on lowering costs, the company anticipates a gross margin of about 25% for the year.

What Is the Target Price for Bloom Energy?

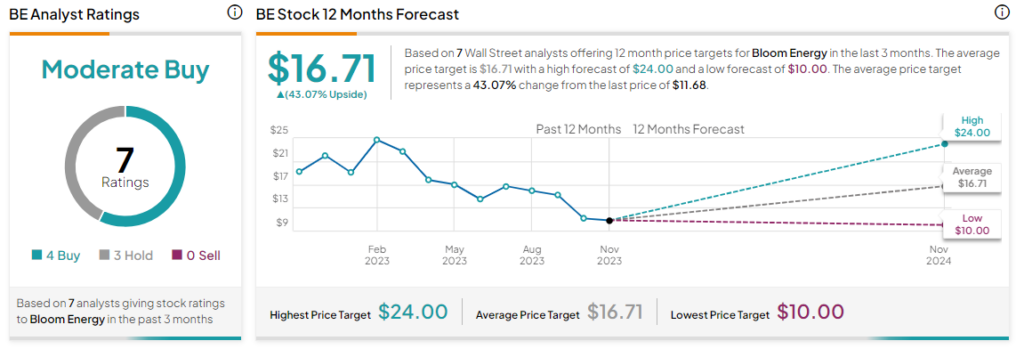

Overall, the Street has a Moderate Buy consensus rating on Bloom Energy. The average BE price target of $16.71 implies a mouth-watering 43% potential upside.

Read full Disclosure