Don’t look now, but the energy sector is heating up again, and the Energy Select Sector SPDR Fund (NYSEARCA:XLE) is quietly up 16% year-to-date, pushing past a new 52-week high.

I’m bullish on XLE based on the momentum in the energy sector, its portfolio of highly-rated energy stocks, and the relatively cheap valuation of these holdings, even after accounting for this strong 2024 performance. I’m also a fan of XLE because of its cost-effective expense ratio and its 3% dividend yield.

Favorable Setup for Energy Prices?

Crude oil prices are quietly up 18.6% year-to-date currently, buoying the energy stocks that extract, refine, and sell the commodity. And many analysts believe that oil prices could have more room to run. Russia is in the process of reducing production, which would reduce supply.

Meanwhile, analysts from Goldman Sachs (NYSE:GS) expect commodities, in general, including oil, to post strong gains over the course of 2024 based on lower interest rates, a recovery in manufacturing, and persistent geopolitical risks.

The Goldman Sachs analysts aren’t alone, as Goldman’s former head of commodities research, Jeff Currie, now with Carlyle Group, also believes this is a favorable setup for oil prices. Currie believes that oil prices could rise “well above” the norm of $70-90 per barrel if the Federal Reserve cuts interest rates in the months ahead.

Beyond the machinations of the Fed, Currie points to additional factors like China moving to bolster manufacturing and Europe working to rebuild its energy reserves as further catalysts, telling Bloomberg TV, “I want to be long oil and the rest of the commodity complex in this environment,” and, “The upside here is significant.”

XLE’s Strategy

XLE invests in an index that, according to the fund, “seeks to provide an effective representation of the energy sector” of the S&P 500 (SPX). XLE aims to give investors “precise exposure to companies in the oil, gas and consumable fuel, energy equipment and services industries.”

Investors can use XLE to “take strategic or tactical positions at a more targeted level than traditional style based investing.”

The ETF launched all the way back in 1998 and is by far the largest and most popular energy-themed ETF in today’s market, with $39.3 billion of assets under management (AUM), making it nearly four times the size of its next-largest competitor, the Vanguard Energy ETF (NYSEARCA:VDE) which has $8.7 billion in AUM.

Highly-Rated Top Holdings

XLE holds just 24 stocks. Its top 10 holdings make up 76.2% of the portfolio, and top holdings ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) have large weightings of 22.8% and 16.5%, respectively, so it has to be said that this isn’t a very diversified ETF. However, as a directional bet on U.S. energy stocks, it gets the job done and is a good representation of the sector.

Below is a look at XLE’s top 10 holdings using TipRanks’ holdings tool.

Furthermore, while there isn’t a lot of diversification, some of the stocks that XLE owns boast fantastic Smart Scores.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Six out of XLE’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above. Chevron tops the list with a ‘Perfect 10’ rating, while ExxonMobil, Phillips66 (NYSE:PSX), Marathon Petroleum (NYSE:MPC), and Williams Companies (NYSE:WMB) all sport impressive Smart Scores of 9 out of 10.

XLE itself boasts an Outperform-equivalent ETF Smart Score of 8 out of 10.

While these holdings score highly based on the Smart Score system and have performed well in 2024, for the most part, their valuations are still undemanding. In fact, as of April 2, the fund’s average price-to-earnings ratio is just 13.6x, representing a significant discount to the S&P 500, which currently has a much higher average price-to-earnings ratio of 23.6.

XLE’s top holding, ExxonMobil, trades at just 13x 2024 consensus earnings estimates, while the second-largest holding, Chevron, trades at a similarly modest 12.5x 2024 earnings estimates.

While energy stocks have performed well so far this year, their valuations are still attractive, and there’s little to suggest that they are tapped out from a valuation perspective.

XLE’s Attractive and Reliable Dividend

Energy stocks have long been known for their durable and above-average dividends, so it’s no surprise that XLE is a dividend payer. The ETF currently yields 3%. Its yield has been higher in the past, but it has gone down as the ETF’s price has gone up, which is a tradeoff most holders will be happy with. Plus, while the 3% yield may not be eye-popping, it’s still more than double the yield of the S&P 500. Furthermore, XLE is as consistent as they come, paying dividends for 24 consecutive years.

What Is XLE’s Expense Ratio?

With an expense ratio of just 0.09%, XLE is super cheap. This 0.09% expense ratio means that if an investor allocates $10,000 into XLE, they will pay just $9 in fees over the course of the year.

Assuming that XLE maintains this current expense ratio and returns 5% per year, this same investor would pay just $115 in fees over a 10-year time horizon, making XLE a very cost-effective ETF.

Is XLE Stock a Buy, According to Analysts?

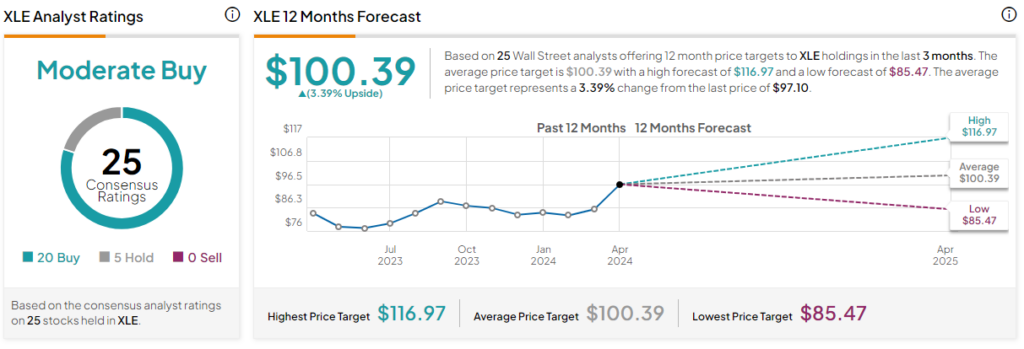

Turning to Wall Street, XLE earns a Moderate Buy consensus rating based on 20 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average XLE stock price target of $101.57 implies 6.2% upside potential.

Investor Takeaway

XLE is off to a nice start in 2024, and there’s plenty to like about it, going forward. I’m bullish on this popular energy ETF based on the potentially favorable climate for oil prices, XLE’s highly-rated group of energy stocks with strong Smart Scores, the relatively inexpensive valuation of these holdings, and XLE’s attractive 3% dividend yield. XLE’s favorable expense ratio also makes it a great way to invest in the space.