Whitehaven Coal Limited (ASX:WHC) shares fell as much as 3.5% on Tuesday, hitting a low of about AU$10. The stock’s decline followed a downgrade at Citigroup.

Citigroup thinks Whitehaven shares have run their race, after surging more than 300% this year. Citigroup lowered its rating on Whitehaven stock to a Sell from a Hold, believing the stock’s valuation has become stretched following spikes in recent months. The broker assigned the stock a price target of AU$8.30, which suggests nearly 20% downside.

Whitehaven’s surging share price & strong dividends

Whitehaven booming share price rise this year has come on the back of an energy crisis in Europe caused by the Ukraine conflict.

The company has also been a favourite of dividend-seeking investors. The company has been paying increasing dividends over the past three years. Whitehaven’s dividend yield of 4.9% is more than double the industry average of 2.2%. Its 20% payout ratio also suggests a stable dividend program.

Is the party over for fossil fuel stocks?

In addition to Whitehaven, New Hope Corp (ASX:NHC) and Stanmore Resources Ltd (ASX:SMR) are the other companies that have benefitted from strong coal prices. They also fell following Citigroup’s downgrade of Whitehaven shares.

While it has been a strong year for many fossil fuel companies, despite the recent boom, their business models are likely to come under pressure over the longer term as the world seeks to shift to renewable energy.

Whitehaven share price prediction

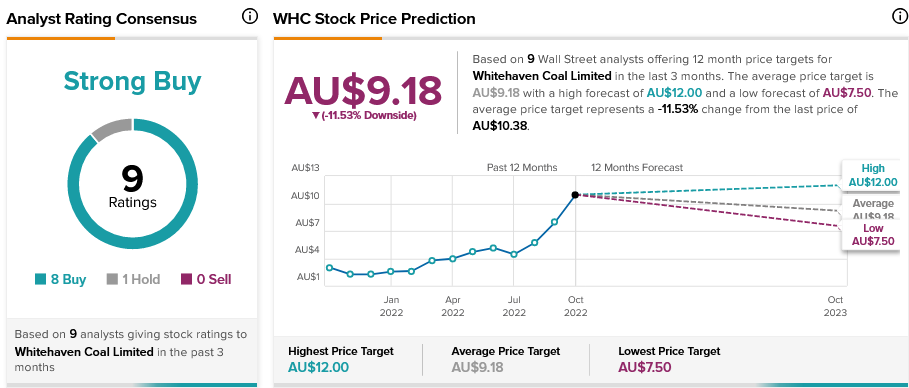

Citigroup is currently alone in recommending that investors sell Whitehaven shares. According to TipRanks’ analyst rating consensus, Whitehaven stock is a Strong Buy. The average Whitehaven price prediction of AU$9.18 shows more than 10% downside potential, a sign that the stock has run faster than analysts expected.

Moreover, Whitehaven scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Aside from the dividend, Whitehaven’s share repurchase program may also continue to draw in investors. The coal miner has already returned more than AU$500 million to investors through share repurchases since March 2022. It plans to launch a fresh buyback program that could be worth more than AU$2 billion.

Concluding remarks

As Whitehaven shares have surged more than 300% this year, there is a strong incentive for some investors to take the profit. However, Whitehaven remains one of the more attractive coal stocks to invest in now, despite the long term challenges facing the fossil fuel industry more broadly.