Today, in our “Expert Spotlight”, we will look at J. Scott Harkness, the founder, Chairman of the Board, CEO, and Portfolio Manager of Provident Trust Company.

June witnessed another record-breaking inflation figure. Have inflationary pressures peaked or is the worst yet to come? Is the economy sliding into a recession or are there more downfalls to follow? All these doubts are making the average investor very anxious about where to park the investible corpus.

At such times, it is prudent to follow the views of experts who are in a better position to gauge the markets and the company’s performance. Notably, TipRanks aggregates the recommendations of several top experts, which can be considered while making investment choices to maximize returns.

Our Expert’s Ranking on TipRanks

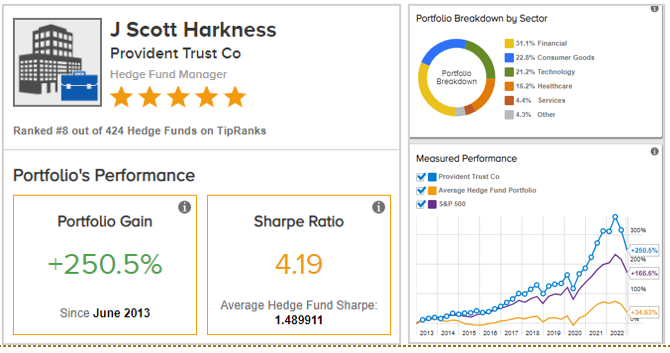

According to TipRanks’ Star Ranking System, Scott is ranked #8 out of 424 hedge funds tracked.

Remarkably, since June 2013, Provident Trust’s portfolio has gained a whopping 250.5% under Scott’s stewardship, beating the returns generated by both the average hedge fund portfolio and the S&P 500 (SPX) during the same period.

A majority of Provident Trust’s investments are focused on the Financial sector (31.1%), followed by the Consumer Goods sector (22.8%). As of date, the Provident Trust fund has $4.9 billion in assets under management.

On an annualized basis, Scott’s investment choices have generated a 28.48% average return over three years. However, due to the tumultuous market conditions, this return has turned negative lately, with the last 12 months averaging a loss of 15.03%.

UnitedHealth Group (UNH)

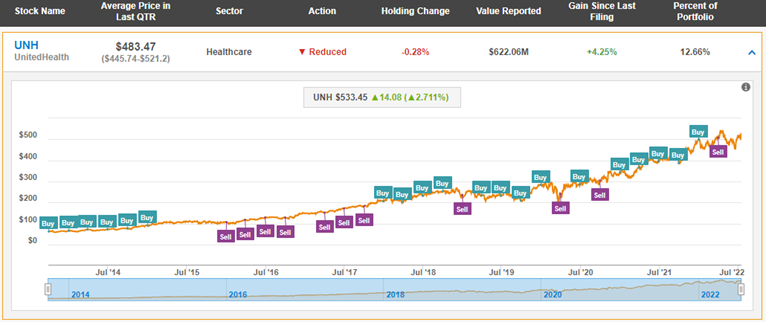

A diversified healthcare company, UnitedHealth takes the number one spot in Provident Trust’s holdings with 12.66% of the overall portfolio, valued at $622.06 million (1,219,802 shares).

Last week, UNH reported robust Q2 results, beating both earnings and revenue estimates. Since the second half of 2012, Scott has consistently recommended a Buy rating on UNH with intermittent Sell calls. UNH stock has gained 6.9% year to date. Scott’s latest call on UNH was a Sell on March 31, 2022, and reduced the exposure by a marginal 0.28%.

As per TipRanks’ Hedge Fund Trading Activity tool, confidence in UnitedHealth is currently Very Negative, as 53 hedge funds decreased their cumulative holdings of UNH stock by 3.8 million shares in the last quarter.

Accenture Plc (ACN)

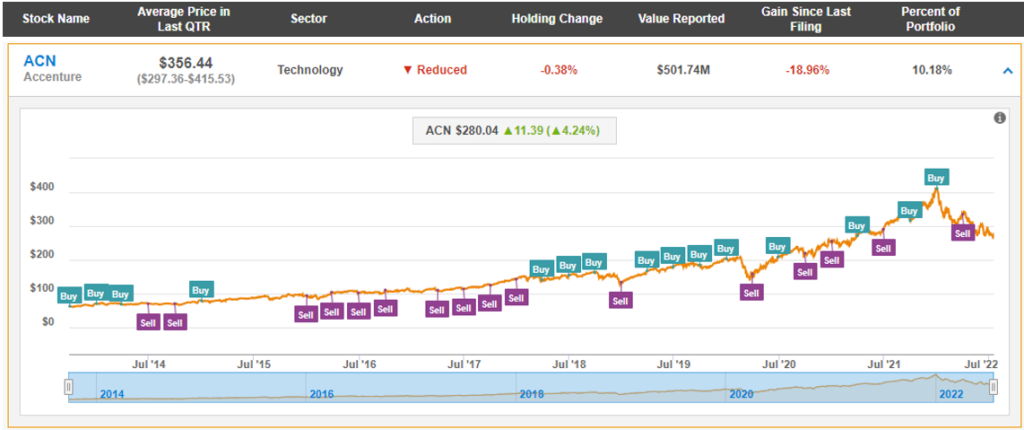

Accenture provides management consulting, technology, and outsourcing services. Accenture holds the second position (10.18%) in Provident Trust’s portfolio, valued at $501.74 million (1,487,833 shares). ACN stock has lost 30.6% year to date.

Scott has recommended Accenture since 2009 with alternating Buy and Sell calls. His latest call on ACN was a Sell call on March 31, 2022, when he reduced his holding by a minor 0.38%.

As per TipRanks’ Hedge Fund Trading Activity tool, confidence in Accenture is currently Very Positive, as 29 hedge funds increased their cumulative holdings of ACN stock by 223,300 shares in the last quarter.

Charles Schwab (SCHW)

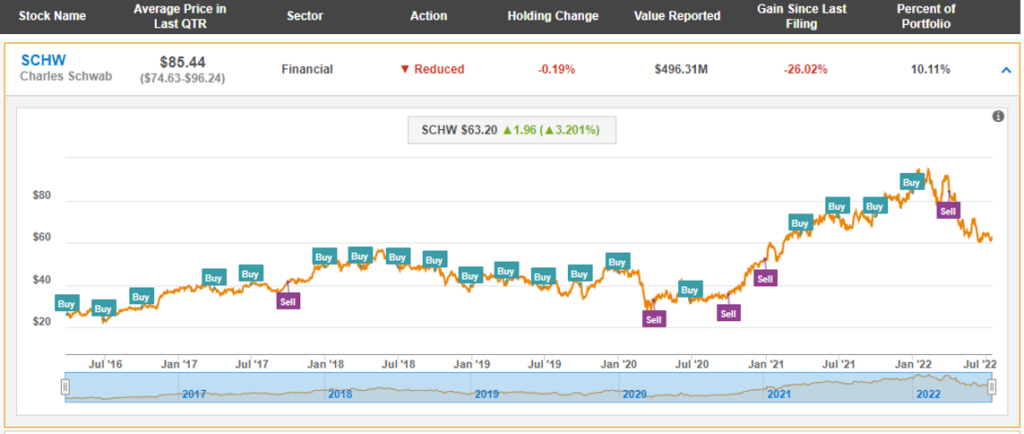

Charles Schwab provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. SCHW holds third place (10.11%) in Provident Trust’s portfolio, valued at $496.31 million (5,886,757 shares). SCHW stock has lost 25.9% so far this year.

On Monday, Charles Schwab posted better-than-expected Q2 results. Scott initiated buying SCHW in 2016 and since then has given consistent Buy recommendations on the stock barring a few Sell calls. Similar to UNH and ACN, Scott reduced exposure to SCHW stock on March 31 by a minor 0.19%.

As per TipRanks’ Hedge Fund Trading Activity tool, confidence in Charles Schwab is currently Very Negative, as 29 hedge funds reduced their cumulative holdings of SCHW stock by 15.9 million shares in the last quarter.

Ending Thoughts

With over forty-four years of investment experience, Scott has served as Chairman and Chief Investment Officer (CIO) at multiple investment firms. Notably, Scott boasts a Sharpe ratio of 4.19, which is much higher than the average hedge fund manager’s ratio and signifies that our expert’s calls typically generate higher returns compared to the risk involved. His recent recommendations on companies might be used as a guiding tool to make informative investment decisions.