In this piece, we’ll have a look at two intriguing defense stocks: Raytheon (NYSE:RTX) and Boeing (NYSE:BA). Raytheon is more of a pure-play defense stocky, while Boeing is a civil aviation kingpin with a smaller, but still respectable defense business. Let’s look closely at each name to see why Wall Street believes that Boeing may be a better fit for your portfolio at today’s valuations.

Defense stocks haven’t been able to steer clear of the market damage in what’s been a pretty terrible year for stocks. With a recession likely up ahead, the defense stocks may prove great ways to play defense with your portfolio at today’s modest multiples.

Undoubtedly, defense plays are also a great way to hedge against an escalation in geopolitical risks. The Russian invasion of Ukraine wasn’t on any investors’ radar prior to the occurrence. Undoubtedly, such black swan events are difficult to even think about. That said, they must be prepared for. The aerospace and defense stocks can serve as a foundation to navigate your portfolio through troubled times.

Looking ahead, China’s move into Taiwan could bring U.S.-China tensions to another level. Undoubtedly, such low-risk, high-impact events are easy to forget about until they happen. With markets picking up negative momentum, I think the broader basket of U.S. defense stocks may finally be worth picking up. Though exogenous events in the geopolitical arena are impossible to forecast, I believe aerospace and defense stocks can help your portfolio weather any future market hailstorms.

Raytheon Technologies

Raytheon stock is flirting with a bear market again, thanks in part to the broader market pullback. The aerospace and defense behemoth is fresh off some decent second-quarter results that saw Raytheon deliver per-share earnings of $1.16, ahead of the $1.12 estimate. The firm, formed from Raytheon Corp. merging with United Technologies, may finally be in a spot to benefit from ongoing integration efforts.

Like most firms, Raytheon is feeling the effects of supply shortages. The company recently noted that it now expects Pratt & Whitney engine deliveries to be delayed. Shares retreated nearly 1% on Thursday following the news.

Despite the delays, CEO Greg Hayes sounded pretty upbeat that his firm can “make up” for most of the deliveries by the end of the year, with some being pushed out to the first quarter of next year.

You can’t really fault Raytheon and company for such delays. It’s hard to find any firm that’s not been impacted by component shortages this year. Fortunately, conditions are poised to normalize going into 2023. Recession or not, Raytheon seems more than capable of living up to its promise that it’ll make up for lost time.

At writing, the stock trades at 28.6 times trailing earnings and 1.9 times sales. That’s a pretty attractive price to pay for such a well-run defense firm that’s held its ground relatively well over the past year.

Is RTX a Good Stock to Buy?

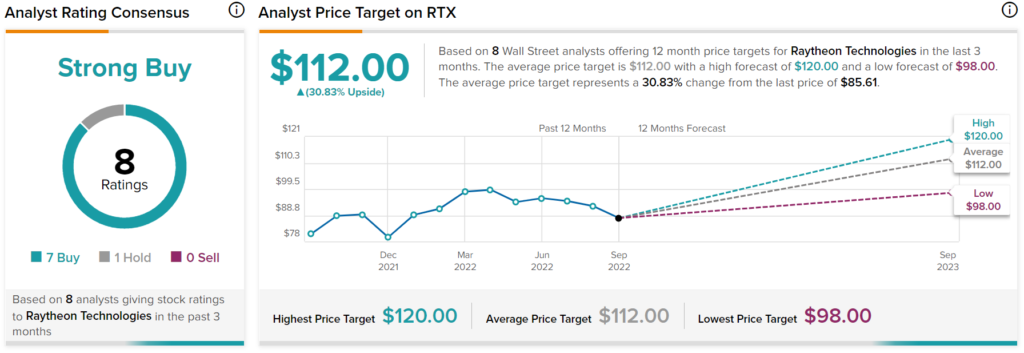

Wall Street remains a fan of Raytheon stock amid its correction, with a “Strong Buy” consensus rating based on seven Buys and one Hold assigned in the past three months. The average RTX stock price target of $112 implies 30.8% upside potential.

Boeing

Boeing is a planemaker that’s been in the headlines for all the wrong reasons over the past three years. Undoubtedly, the grounding of the 737 MAX applied pressure on the stock well before the coronavirus pandemic dragged shares to even lower levels.

Though Boeing and the air travel industry have improved in recent years, Boeing stock hasn’t done much. At below $150 per share, Boeing is actually below where it was during its late March 2020 peak.

Undoubtedly, Boeing is not out of the woods yet. Orders for 737 MAX and 787 — both planes have had more than their fair share of challenges — need to start coming in before the stock can lift off meaningfully again. For now, management has been relatively quiet regarding the specifics of the production of the MAX aircraft.

Analysts may penalize BA stock for less clarity, but I think it’s only prudent to be lacking in guidance rather than run the risk of overpromising and underdelivering. Indeed, Boeing has a history of doing such. In any case, Boeing does expect 787 and 737 MAX deliveries to increase moving forward.

Though it’s difficult to project year-ahead orders, I think easing supply woes (especially engine castings) will resolve in due time. Investors seem impatient with the stock, but orders will start coming in again, as the firm gets production where it needs to be.

Sure, Boeing can’t keep blaming the harsh macro environment for coming up short, but at the end of the day, airlines either have Boeing or rival Airbus when it comes to new planes. As such, I think patient investors will be rewarded as Boeing gets going again and customers finally have the means to order.

In the meantime, Boeing’s defense business is performing relatively well, with flat growth to be expected.

Is BA Stock a Buy Now?

Wall Street loves Boeing stock, with 11 Buys and two Holds assigned over the past three months. It’s no mystery why analysts have the name at a Strong Buy. It’s a part of a duopoly, with a 1.4 times sales multiple that’s way too depressed. The average BA stock price forecast is $218.91, equating to 46.2% upside potential.

Conclusion

Both aerospace and defense stocks are in the gutter over ongoing supply issues. As 2023 rolls around, I think both firms could be in a spot to beat the market. At writing, Wall Street expects the most from Boeing, with more than 46% in upside expected over the next year.