PDC Energy, Inc. (NASDAQ:PDCE) is a $6.4-billion oil and gas exploration and production company in the United States. With solid fundamentals and prospects, the upstream company presents an attractive investment option for prospective investors seeking exposure to the U.S. oil and gas industry.

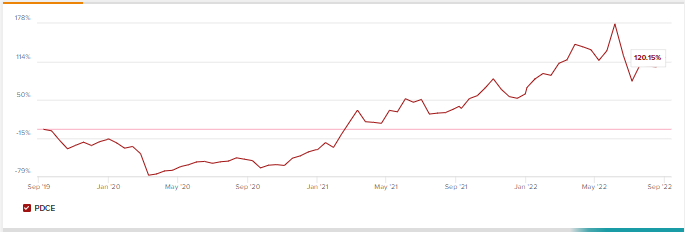

The Denver, CO-based upstream company develops and operates properties in the Delaware Basin and the Wattenberg Field in west Texas and Colorado, respectively. Year-to-date, shares of PDC Energy have grown 28.3%. PDCE stock closed at $66.83 on Friday.

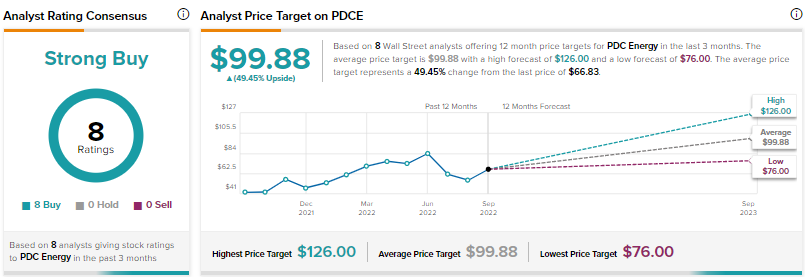

Notably, PDC Energy is in the good book of analysts tracked by TipRanks. PDC Energy enjoys a Strong Buy consensus rating based on eight unanimous Buys. PDCE’s average price forecast of $99.88 reflects upside potential of 49.45% from the current level. The highest price target is $126 and the lowest is $76.

Factors Supporting PDC Energy’s Investment Appeal

The company is well-rooted in Colorado, which is considered the fifth largest oil-producing state in the United States. Exiting 2021, PDC Energy’s total proved reserves were 738 million barrels of oil equivalent (MMBoe) in the Wattenberg field in Colorado. This accounts for 91% of the company’s total proved reserves of 814 MMBoe in the year.

In June 2022, the company’s Broe Oil & Gas Development Plan permit was approved by the Colorado Oil and Gas Conservation Commission. Also, the company acquired Denver-based Great Western Petroleum, LLC in May. These events are expected to boost PDC Energy’s footprint in Colorado.

Such investment activities are supported by the company’s solid cash position, which stood at $1,234 million in the first half of 2022. For 2022, the company expects to generate $2,650 million in adjusted cash flow from operations. Further, it anticipates capital expenditure in the range of $1.025-$1.075 billion in 2022.

Also, PDC Energy is committed to lowering its leverage in the quarters ahead. For 2022, the company targets a net leverage ratio to be 0.5x versus 0.7x at the end of the second quarter of 2022. Long-term debts are forecast to be $1.3 billion at the end of 2022 versus $1.7 billion at the end of Q2.

Moreover, the company is committed to rewarding its shareholders with dividend payments of $125 million and share buybacks of $625-$675 million in 2022. This shareholder-friendly stance of PDC Energy keeps its stakeholders interested in the stock.

Noteworthy, PDC Energy is also focused on reducing the environmental impacts of its operations. It plans to spend $100 million to lower methane and GHG emissions in the years ahead.

Bloggers and Retail Investors Are Bullish on PDC Energy

Per TipRanks, financial bloggers are 100% Bullish on PDC Energy versus the sector average of 72%. Retail investors, too, share a similar sentiment. The total number of portfolios with exposure to PDCE stock has increased 1.9% in the past 30 days. Further, top portfolios tracked by TipRanks increased their investments in PDC Energy by 1.6% in the past month.

Concluding Remarks for PDC Energy’s Prospective Investors

As of now, PDC Energy seems to be well-positioned to benefit from high oil and natural gas prices, which are being supported by healthy demand, supply-chain bottlenecks, and production cuts by the Organization of the Petroleum Exporting Countries (OPEC).

Further, the company’s nine out of 10 Smart Score on TipRanks mirrors its potential to outperform the broader market.

From the above discussion, it is evident that both macro and micro tailwinds are supporting the company’s growth story, making it a good investment option for prospective investors. The stock’s price chart, depicting its performance over the years, is provided below.

Read full Disclosure