Between the Metaverse, cryptocurrency, and AI, plenty of new investment themes have emerged in recent years, at the same time as more individual and retail investors started investing during the pandemic. Predictably, a wave of new ETFs launched in an attempt to capitalize on these new trends.

However, according to a new Wall Street Journal article, many of these thematic and niche-focused ETFs are closing up shop. In fact, so far in 2023, 929 ETFs have closed worldwide, up from just 373 this time last year, according to research from ETFGI. In the United States, 178 exchange-traded products have shut down, already exceeding last year’s total of 142.

According to the Wall Street Journal, this is the highest number of closures since 2020, when collapsing oil prices led to the demise of many energy-themed funds. Here’s why.

It’s Hard to Compete with the 800-Pound Gorillas in the Room

Many of these ETFs are learning that it’s hard to attract capital in a crowded market where there is no shortage of competition and where the biggest ETFs from the largest asset managers dominate. These more established ETFs have the size and scale to offer investors low expense ratios and have long track records of performance that investors can look to, making it hard for newcomers to dislodge them.

Making matters more difficult for these new entrants is the fact that while the stock market has done well this year — the S&P 500 (SPX) is up 18.1% year-to-date, while the Nasdaq (NDX) is up 35.0% — a large portion of these gains come from just a handful of mega-cap tech stocks, known as the “Magnificent Seven.” The Wall Street Journal reports that through May, these powerhouse stocks were responsible for virtually all of the market’s year-to-date gains.

Investors looking for exposure to these seven tech behemoths — Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA) — don’t really need to look beyond large, popular technology ETFs like Invesco QQQ Trust (NASDAQ:QQQ) and Technology Select Sector SPDR Fund (NYSEARCA:XLK) to gain exposure to these stocks.

QQQ and XLK are good examples of the large ETFs that dominate the market. QQQ boasts nearly $200 billion in assets under management (AUM), a staggering figure, while XLK is smaller than QQQ but is still approaching $50 billion in AUM. With their massive size and scale, these two leading tech ETFs are able to offer investor-friendly expense ratios of 0.20% and 0.10%, respectively.

Staying within technology, smaller but still-popular ETFs like the ARK Innovation Fund (NYSEARCA:ARKK) have much higher expense ratios of 0.75%, and this disparity in fees and expenses makes a significant difference to investors when compounded over time.

The extent to which these mega-cap stocks (and massive ETFs) have dominated the market as of late leaves would-be competitors gasping for oxygen and fighting for scraps. Furthermore, because the Magnificent Seven have racked up such significant gains this year, they are now the largest seven stocks in the S&P 500.

This means that an investor can simply invest in broad market, low-cost S&P 500 ETFs like the Vanguard S&P 500 ETF (NYSEARCA:VOO) or the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) to gain exposure to all of these stocks.

This is a conundrum for smaller and newer ETFs. On the one hand, investing in these stocks isn’t going to be enough to stand out in the crowd, especially when incumbents like VOO, SPY, XLK, and QQQ have lower expenses and lower track records. Trying to compete with these ETFs is like fighting the proverbial 800-pound gorillas in the room.

On the other hand, because these stocks are propelling much of the market’s overall gains in 2023, many individual investors simply don’t seem particularly interested in chasing other ideas and themes like the Metaverse or some of the politically-themed ETFs that have launched in recent years.

There is an Alternative

Another factor that is making it tough sledding for smaller, narrowly-focused ETFs is that rising interest rates have given investors more alternatives to consider when looking for returns. For years, we all heard the mantra “there is no alternative,” which became so commonplace it even earned its own acronym, “TINA.”

But now, for the first time in years, individual investors do have viable alternatives to stocks. Treasury bond yields have risen to decade-highs, and investors can also earn decent risk-free returns by parking money in Certificates of Deposit and money-market accounts. The new viability of fixed-income investing means that money is flowing into fixed-income ETFs as opposed to the latest ETF with a cute ticker attempting to capitalize on the latest trend.

It’s Not All Bad News for New ETFs

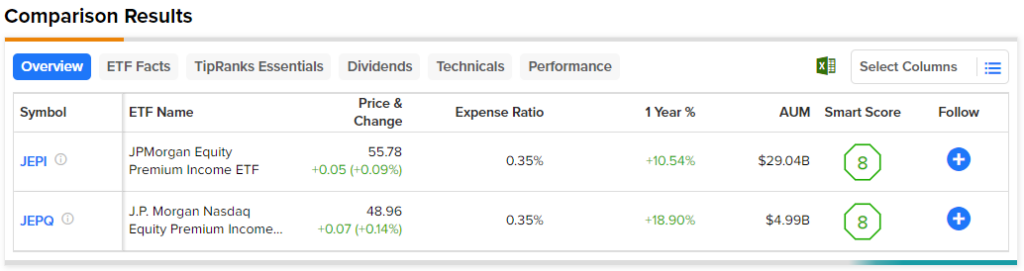

All of that said, there are some outliers out there in newer ETFs that are bucking the trend and seem to be establishing real staying power. For example, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) only launched in 2020 but has quickly garnered nearly $30 billion in AUM, meaning that it has already grown into the market’s largest actively-managed ETF in just a few short years of existence.

JEPI has stood out from the crowd and gained traction with investors by offering a double-digit dividend yield of 10.0% and a monthly payout schedule, with a strategy of selling covered calls to boost its payout. Similarly, JEPI’s cousin, the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) launched last May and has already accumulated $5.0 billion in assets under management. Like JEPI, JEPQ pays a double-digit dividend yield of 11.5% and makes monthly payouts but invests in the Nasdaq instead of the S&P 500.

Below, you can view a comparison of the two ETFs using TipRanks’ ETF comparison tool.

The Takeaway

In conclusion, investors today have more choices than ever when it comes to investing in ETFs, with a bevy of new options launching for each hot theme that emerges. However, many of these ETFs never end up gaining traction with investors and end up shutting down. Essentially, when it comes to ETFs, the competitive landscape is a Darwinian “survival of the fittest,” and not everyone is going to attract enough capital to survive.

The ETF market may benefit from a “thinning of the herd” in which some of the weaker ETFs that have not found a product-market fit go by the wayside. The Wall Street Journal previously found that “because many newly launched ETFs are risky attempts to capitalize on the latest trend, they end up investing in overvalued stocks. One consequence is that such funds, on average, can be expected to lag behind the broad market’s returns over at least five years after launch—if they even live that long.”

Thus, ETFs looking to capitalize on the latest trend may be late to the party and are buying in after large gains have already been made. Meanwhile, some ETFs, such as politically-themed ones or ones that let you invest alongside or fade the picks of prominent investing personalities, are better characterized as gimmicks than viable long-term investing strategies.

These ETFs face a challenging landscape right from the beginning, as offering investors exposure to the typical large-cap growth and tech stocks won’t give them much differentiation against the market’s top ETFs, but conversely, offering different exposure may not interest investors either.

However, the massive success of a few new ETFs like JEPI and JEPQ shows that it is still possible to gain success if an ETF finds a differentiated strategy that appeals to investors.