Shares of online e-commerce marketplace eBay (NASDAQ:EBAY) are down about 50% from their 2021 all-time high. The stock might remain range-bound in the near term, contingent on the holiday season results. However, the company is delving into AI and gaining momentum in the advertising platforms. Given its cheap valuation, I will buy EBAY stock for its consistent delivery of value to shareholders through dividends and buybacks, coupled with robust business fundamentals. I’m bullish on EBAY stock.

Mixed Q3 Earnings & Disappointing Holiday Season Forecast

On November 7, eBay reported mixed Q3 results. Q3 EPS of $1.03 grew 3% year-over-year and exceeded analysts’ expectations of $1.00. Revenues, however, were essentially in line with expectations and grew by 5% to $2.5 billion.

Positively, eBay’s first-party advertising platform continues to expand. It witnessed significant growth of 39% to $345 million during Q4. Further, the company reported better-than-expected GMV growth of 2% to $18 billion during Q3 (driven by continued product improvements) versus declining growth in the last few quarters.

Negatively, however, active buyers declined 3% year-over-year to 132 million. Moreover, operating margins declined to 26.4% compared to 28.9% for the same period last year. Margins are expected to remain compressed in the upcoming fourth quarter as eBay continues its investments toward GMV growth.

Disappointingly, eBay expects the upcoming holiday season in December to witness lower-than-expected consumer spending. The company said that its non-U.S. regions, which generate more than 50% of revenues, remain weak, especially in Europe and Germany, leading to a muted Q4 outlook.

Due to macro uncertainties, eBay expects Q4 revenues to be largely flat (expected a 1% decline to growth of 2%) and come in the range of $2.47 billion – $2.53 billion, lower than the consensus expectation of $2.60 billion. EPS is expected to hover between $1.00 to $1.05 versus expectations of $1.04.

It’s not just eBay. Its key competitors, like Amazon (NASDAQ:AMZN) and Etsy (NASDAQ:ETSY), also presented results that imply that discretionary spending will remain curbed due to high interest rates and inflationary pressures.

Separately, in Q3, eBay introduced its new magical listing tool that employs AI technology to significantly simplify the process of listing an item on eBay. With AI tools, sellers and buyers can expedite the listing process, making it more seamless and informative, thereby improving the overall shopping experience. This innovation is poised to draw more people to the eBay platform, enhancing website traffic and ultimately contributing to increased revenues in the long run.

Impressive Returns Via Dividends & Share Buybacks

eBay has a strong track record of returning great value to shareholders via share buybacks and dividends. During Q3 alone, the company bought back $651 million worth of shares and paid $132 million in dividends. This implies a solid return of 3.6% in just one quarter.

Looking at a longer time horizon, since January 2022, the company has returned $5.9 billion to shareholders via dividends and share buybacks. This implies a massive 28% return in almost two years based on the current market cap of $21.1 billion. As of September 30, the total repurchase authorization remaining was $1.7 billion, leaving room for more buybacks in the future.

On top of that, eBay has grown its quarterly dividend at a CAGR of more than 16% between 2019 and 2022. eBay’s current dividend yield is attractive at 2.4% and is superior to its peer group average of 0.99%. Its current payout ratio of 22.9% is also reasonable.

Importantly, the company has ample cash flows to support the dividends and buybacks. During 2022, the company registered a free cash flow yield of 8% of the current market cap, which is very impressive.

eBay’s cash position will be further boosted by the potential sale of 50% of its stake in Adevinta. The deal is expected to generate $2.2 billion in cash and comes at a significant premium of $1.5 billion to the valuation of eBay’s entire stake in Adevinta (the offer values the entire stake at $4.3 billion). eBay will exchange its remaining shares for an equity stake of approximately 20% in the newly-privatized firm.

The incremental cash generated from the deal will help eBay easily finance its previously mentioned target to return ~125% of cumulative free cash flow to shareholders through repurchases and dividends from 2022 to 2024.

Is eBay Stock a Buy, According to Analysts?

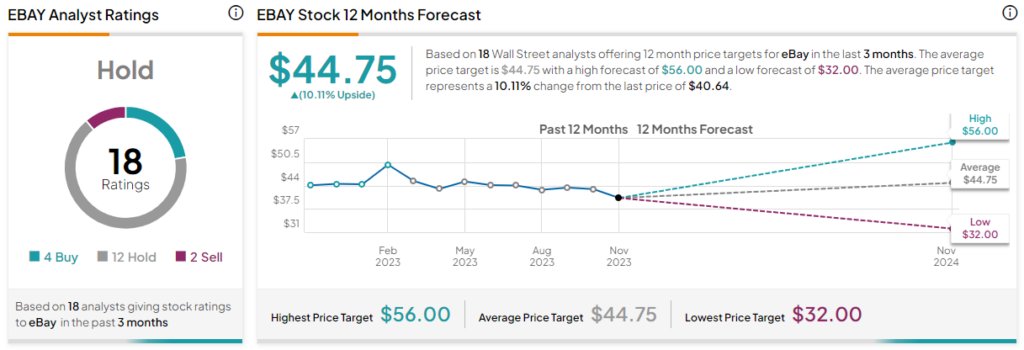

Turning to Wall Street, analysts have a Hold consensus rating on eBay stock, which is based on four Buys, 12 Holds, and two Sells. The average eBay stock price forecast of $44.75 implies 10.1% upside potential.

In terms of its valuation, eBay is extremely cheap. Currently, it’s trading at an attractive P/E ratio of 8.2x compared to much higher multiples of its peer group. For example, e-commerce giant Amazon is trading at a P/E of 76.8x, while online marketplace company Etsy is trading at over 31x.

Conclusion: Consider eBay as a Long-Term Stable Income Stock

Given the highly competitive landscape, eBay is not the ideal choice for growth investors seeking double-digit growth in revenues and earnings. eBay is better suited for a passive investor seeking consistent dividends and returns via buybacks from a company with a strong cash position and robust business fundamentals. The company’s current valuation offers an appealing entry point for such investors.

Additional growth stemming from GMV growth, AI initiatives (including generative AI), and advertising momentum will serve as incremental benefits for holding the stock