Growing inflation and a challenging environment have put a lot of pressure on businesses in the UK – which means business consultancy company and insolvency expert Begbies Traynor (GB:BEG) is well-positioned to drive better earnings.

The shares of Begbies Traynor are back in the recovery zone after hitting a low point below 100p in March 2022. The favourable numbers in the recently released trading update further supported the share prices.

Overall, the stock has grown almost 5% in the last year.

The upside

The company has a solid track record of revenue growth over the years. In its last annual results, the company posted another successful year with revenue growth of 31% and a profit growth of 55%.

The company has already made a positive start to the next fiscal year. It expects its results to be at the top end of the guidance range. The company said its first-quarter numbers already look promising and are in line with expectations.

Begbies Traynor also has the advantage of a diverse range of services, which leads to multiple income sources. This provides a wholesome growth opportunity across various stages of the economic cycle.

Analysts View

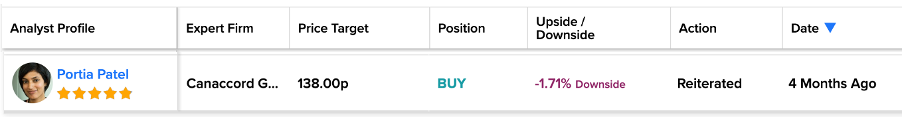

Canaccord Genuity analyst Portia Patel commented on the recent trading update, “We continue to believe the current macro outlook should provide very favourable trading conditions for Begbies’ counter-cyclical activities, which comprise 70% of total revenues.”

Patel had a Buy rating on the stock with a success rate of 94%.

Shore Capital analyst Vivek Raja said, “As mooted in the full year results statement on 19 July, activity levels in midmarket administration are picking up which could drive an acceleration in growth and operating margin progression within the core insolvency practice.”

What does Begbies Traynor do?

Begbies Traynor is among the leading consulting firms in the UK, specializing in advisory services and solutions in different business areas.

The company’s services guide on corporate recovery, restructuring, insolvency, corporate finance, real estate advisory, forensics, asset sales, and many more.

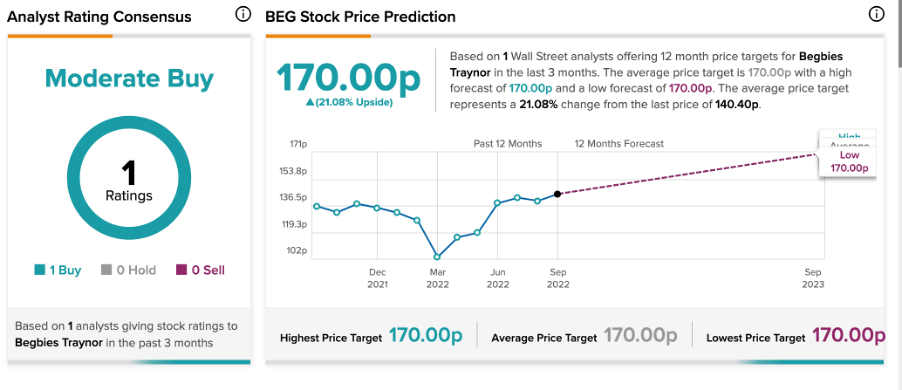

Begbies Traynor share price forecast

According to TipRanks, Begbies Traynor stock has a Moderate Buy rating, based on one Buy recommendation from Berenberg Bank analyst James Bayliss.

He has a target price of 170p, which has an upside potential of 21%.

Conclusion

Overall, the company remains in a comfortable position to meet its next-year targets.

It has a cash-rich balance sheet, which supports its acquisition strategies and helps in achieving its growth initiatives. The company has a good pipeline for organic growth opportunities as well.

In the current turbulent environment, the demand for the company’s advisory services will further increase, driving up profits. Share prices could further gain some action along the way.