Amid heightened geopolitical tension, inflation, a stricter monetary policy, and fears of a recession, politicians in the U.S. have been actively trading in five mega-cap companies: Merck & Co., Inc. (NYSE: MRK), Exxon Mobil Corporation (NYSE: XOM), NVIDIA Corporation (NASDAQ: NVDA), Johnson & Johnson (NYSE: JNJ), and The Home Depot, Inc. (NYSE: HD).

It is worth noting that U.S. politicians — Senates and Representatives — are bound by the country’s transparency guidelines to disclose their exposure to the stock market.

Tracking the buying and selling activities, or the timings and amount of trades, that are conducted by U.S. politicians, could yield vital information for investors. Before making a jump, it is also imperative for investors to carefully study the fundamentals of the company, the industry, and the trade activities of insiders and hedge funds.

The five actively traded companies belong to major U.S. industries, including healthcare, technology, utilities, and consumer goods. Using TipRanks’ stock comparison tool, I designed a consolidated chart of these politician-traded companies:

Merck & Co., Inc. (NYSE: MRK)

Description: Drug manufacturing company

Market Capitalization: $233.6 billion

YTD Share Price Movement: Up 16.6%

Trades & Trade Date: 2 Sell Trades on June 29, 2022

Traded by: Rohit Khanna, U.S. Representative

Rohit Khanna, the California congressman, is among the most active Democrats trading in the U.S. stock markets. He conducted 139 trades (Buys and Sells) in the past month. Regarding MRK, his first Sell trade was for 11-163 MRK stocks (valuing $1,000 to $15,000), and the second Sell trade involved 163-541 stocks of Merck (worth $15,000 to $50,000). In addition to Khanna, hedge funds have decreased their holdings in MRK stock by 1.8 million shares in the last quarter.

Solid product offerings (especially in Oncology), clinical advancements in multiple projects, collaboration with Orion Corporation, and gains from buyouts would prove a boon for the company in the quarters ahead. On TipRanks, the company has a Moderate Buy consensus rating, based on eight Buys and three Holds. Also, MRK’s average price target of $100.36 suggests upside potential of 11.34% from the current level.

Exxon Mobil Corporation (NYSE: XOM)

Description: Oil exploration and production company

Market Capitalization: $371.9 billion

YTD Share Price Movement: Up 40.5%

Trades & Trade Date: 1 Sell Trade on June 23, 2022

Traded by: Virginia Fox, U.S. Representative

Virginia Fox, a North Carolina congresswoman, sold roughly 1,174-2,934 shares of XOM, valuing them within the $100,000 to $250,000 range. Including this transaction, the Republican executed 10 trades (Buys and Sells) in multiple stocks. Corporate insiders and hedge funds have also lowered their stakes in the company in the last three months.

It is worth noting that the company has a Strong Buy consensus rating based on 12 Buys and four Holds. XOM’s average price forecast of $107.61 mirrors upside potential of 22.63% from the current level. The oil & gas company’s solid production capabilities, ongoing projects, and effective capital allocation policies give the stock an edge over its competitors.

NVIDIA Corporation (NASDAQ: NVDA)

Description: Semiconductor manufacturing company

Market Capitalization: $424.8 billion

YTD Share Price Movement: Down 40.9%

Trades & Trade Date: 1 Buy Trade on July 8, 2022

Traded by: Pete Sessions, U.S. Representative

Texas congressman Pete Sessions’ Buy transaction included 15 shares of NVIDIA, valued at $1,000 to $15,000. This Republican conducted just two Buy trades (including NVDA) in the past month. Like Sessions, hedge funds seem to be interested in NVIDIA, as evident from the increase in their holdings in the last quarter. However, insiders have dumped the stock in the last three months.

The government’s intervention in the semiconductor market, as well as NVIDIA’s expertise in manufacturing chips used in multiple fields, enhance its appeal. The company is in the good books of analysts, as can be seen from a Strong Buy consensus rating based on 26 Buys and five Holds. Also, NVDA’s average price forecast of $253.87 offers upside potential of 40.65% from the current level.

Johnson & Johnson (NYSE: JNJ)

Description: Healthcare products maker

Market Capitalization: $449.2 billion

YTD Share Price Movement: Down 0.5%

Trades & Trade Date: 1 Buy Trade on June 28, 2022

Traded by: John Curtis, U.S. Representative

The Republican congressman from Utah purchased six to 85 shares of Johnson & Johnson, with the total value of the transaction varying within the $1,000 to $15,000. Apart from this transaction, Curtis bought and sold shares of other companies in 10 different transactions in the past month. Interestingly, hedge funds have also increased their exposure to JNJ stock by 493,400 shares in the last quarter. However, corporate insiders have sold JNJ stock worth $13.9 million in the last three months.

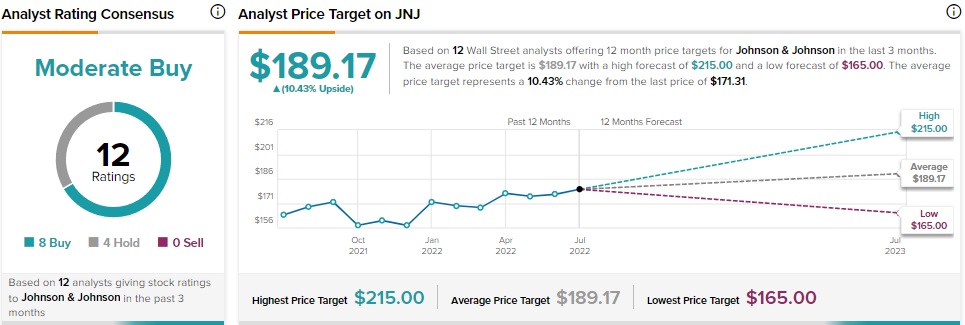

The company has a Moderate Buy consensus rating based on eight Buys and three Holds. JNJ’s average price forecast of $189.17 commands 10.43% upside potential. Favorable regulatory decisions and solid demand for healthcare solutions globally are benefiting Johnson & Johnson.

The Home Depot, Inc. (NYSE: HD)

Description: Retailer of home improvement products

Market Capitalization: $310.7 billion

YTD Share Price Movement: Down 26%

Trades & Trade Date: 1 Buy Trade on June 27, 2022

Traded by: Rohit Khanna, U.S. Representative

Khanna bought four to 54 shares of Home Depot in a transaction worth $1,000 to $15,000. It is worth noting that corporate insiders and hedge funds have decreased their holdings in HD stock in the last three months.

Growth in orders, production innovation, and a solid footprint across countries strengthen the prospects of Home Depot. On TipRanks, the company has a Moderate Buy consensus rating based on 17 Buys and six Holds. HD’s average price forecast of $348.41 suggests 14.23% upside potential from the current level.

Mega-Cap Outperformers

The stocks discussed above either have a Strong Buy or a Moderate Buy consensus rating, and their average price target offer at least 10% upside potential. Prospects look bright for these mega-cap players. The fact that these companies are part of the portfolios of U.S. politicians further arouses investor interest in them.

Read full Disclosure