These are the 3 Stocks that Hedge Funds are adding massively to their portfolios. Moreover, these stocks are favored by Wall Street analysts with a Strong Buy consensus and high price targets. We used the TipRanks Stock Screener tool to scan for stocks that have a Very Positive Hedge Fund Confidence Signal and have bullish reviews from analysts.

Hedge fund managers pick stocks based on years of thorough research, company-specific knowledge, and market understanding. Investors seeking attractive returns on investments can refer to the stocks that hedge funds are loading up. Let’s dive right into these companies and learn why they are such lucrative investments.

#1 AT&T (NYSE:T)

Texas-based AT&T is one of the world’s largest telecommunications companies. The company is well-positioned to benefit from the growing adoption of 5G and fiber technology. T stock also pays a healthy dividend of $0.28 per share, carrying an above-average yield of 6.69%.

As per the TipRanks’ Hedge Funds tool, AT&T has a Very Positive Hedge Fund Confidence Signal based on the activities of 27 hedge funds. Overall, hedge funds increased their T holdings by 4.9 million shares in the last quarter.

On April 24, T reported mixed Q1 FY24 results, with earnings exceeding but revenue falling short of estimates. Revenue fell 0.4% year-over-year to $30 billion and adjusted earnings per share (EPS) of $0.55 declined by $0.05 from Q1 FY23.

In the quarter, AT&T recorded 349,000 postpaid phone net adds and 252,000 AT&T Fiber net adds, reflecting growing momentum in Mobility and Consumer Wireline connectivity businesses.

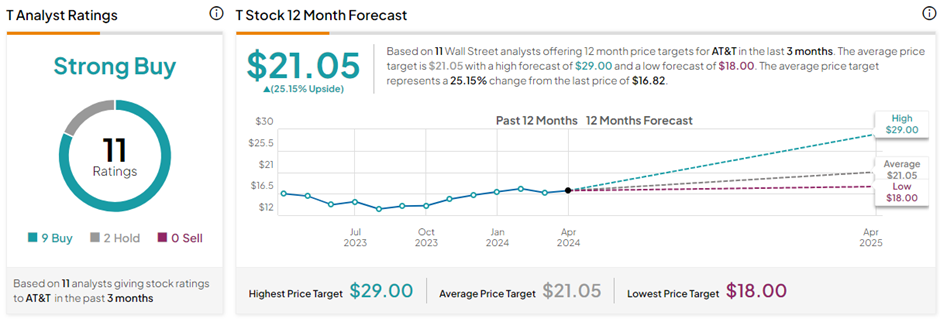

Is AT&T a Buy, Sell, or Hold?

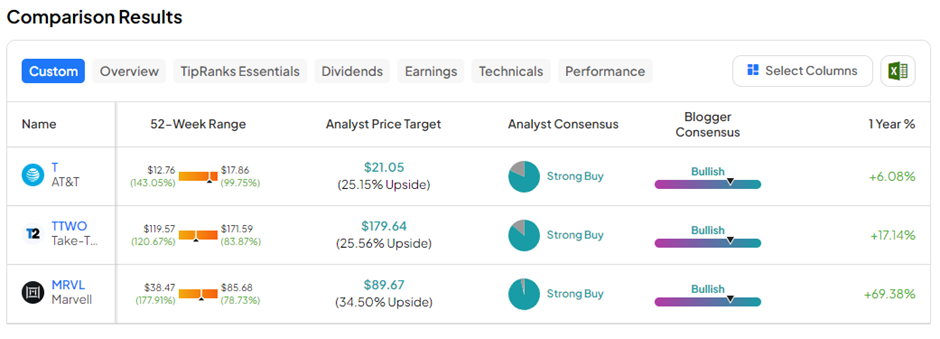

On TipRanks, T stock commands a Strong Buy consensus rating based on nine Buys and two Hold ratings. The average AT&T price target of $21.05 implies 25.1% upside potential from current levels. In the past year, T shares have lost 1.6%.

#2 Take-Two Interactive Software (NASDAQ:TTWO)

New York City-based Take-Two Interactive Software develops, publishes, and markets interactive entertainment for consumers around the globe. Its games are designed for console gaming systems, PC, smartphones, and tablets, and are delivered through physical retail, digital download, online platforms, and cloud streaming services.

Take-Two Interactive Software has a Very Positive Hedge Fund Confidence Signal based on the activities of 14 hedge funds. Overall, hedge funds increased their holdings of TTWO shares by 3.1 million in the last quarter.

TTWO is set to release its Q4 and full year 2024 results on May 17. The Street expects TTWO to post diluted EPS of $0.08 on revenues of $1.31 billion.

In its Q3 update, the company lowered its full-year net bookings guidance to the range of $5.25 to $5.3 billion owing to softness in mobile advertising and sales for NBA 2K24. Having said that, Take-Two has a strong pipeline of games for Fiscal 2025, including the release of the much-awaited Grand Theft Auto VI title. In the meantime, TTWO is working rigorously to curtail its expenses and maximize margins by shutting studios and laying off staff.

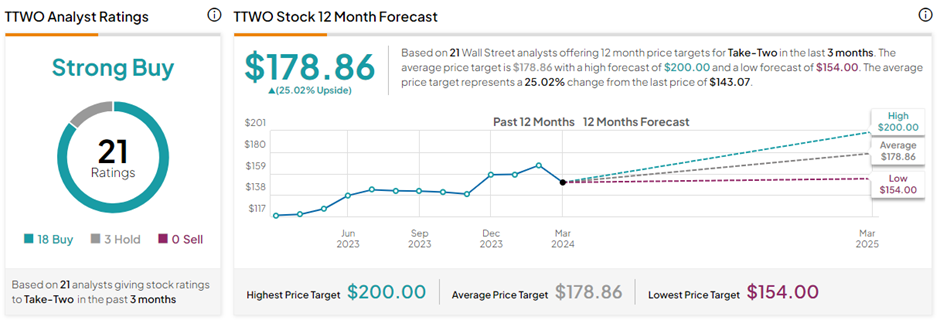

Is TTWO a Good Stock to Buy?

With 18 Buys and three Hold ratings, TTWO stock has a Strong Buy consensus rating on TipRanks. The average Take-Two Interactive Software price target of $178.86 implies 25% upside potential from current levels. In the past year, TTWO shares have gained 17.1%.

#3 Marvell Technology (NASDAQ:MRVL)

Marvell Technology is a semiconductor company that designs, develops, and markets analog, mixed and digital signal processing, and embedded and standalone integrated circuits. The company’s portfolio of semiconductor technology accelerates the functioning of AI, cloud, carrier, automotive, and enterprise infrastructure.

In the last quarter, hedge funds increased their holdings of MRVL stock by 2.4 million shares. The stock is awarded a Very Positive Hedge Fund Signal based on the activity of 21 hedge funds. Marvel also pays a regular quarterly dividend of $0.06 per share, reflecting a yield of 0.35%.

Marvell is set to release its Q1 FY25 results later this month. The Street expects Marvell to post adjusted EPS of $0.24 on revenue of $1.17 billion, much in line with the company’s own guidance. Marvell is betting big on growing revenue from its artificial intelligence (AI) vertical. The company even stated at its recent AI event that it expects AI revenue to exceed $2.5 billion by FY26 compared to about $200 million earned in FY23.

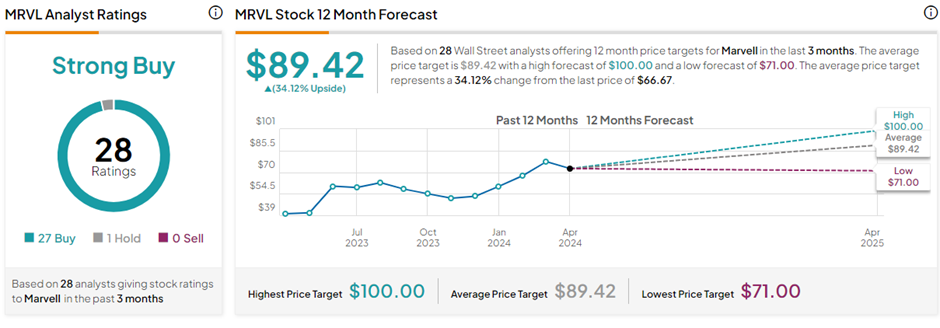

Is MRVL a Buy or Sell?

MRVL stock has a Strong Buy consensus rating, backed by 27 Buys and one Hold rating. The average Marvell Technology price target of $89.42 implies 34.1% upside potential from current levels. MRVL shares have gained 68.7% in the past year.

Key Takeaways

The above three stocks have won the favor of hedge funds, who are betting on their potential future outperformance. Furthermore, analysts support these stocks and see strong upside potential in the next twelve months, making them interesting stocks to consider for one’s portfolio.